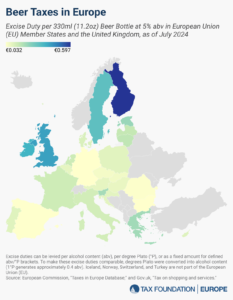

- EU Beer Tax Requirements: The European Union mandates a minimum excise duty of €1.87 per 100 liters of beer, translating to a tax of approximately €0.0309 ($0.0334) for a standard 330 mL bottle of 5% alcohol beer, but most Member States impose significantly higher rates.

- Variability in Tax Rates: Beer tax rates vary widely across EU countries, with Finland having the highest tax at €0.597 ($0.646) per bottle, followed by the UK (€0.413) and Ireland (€0.372), while Bulgaria, Germany, and Luxembourg have the lowest rates, around €0.0316 to €0.0327.

- Additional VAT Considerations: In addition to excise taxes, EU countries impose a value-added tax (VAT) on the sales price of beer, contributing further to the overall cost consumers face when purchasing beer.

Source Tax Foundation