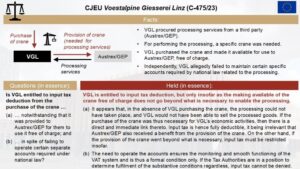

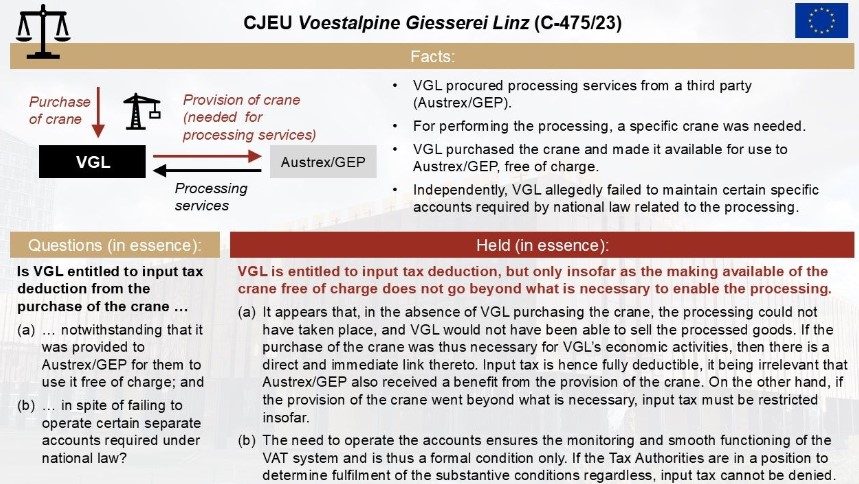

- The CJEU often defers to business judgment regarding whether an expense serves business needs, allowing input VAT recovery even if tax authorities view it as excessive. Cases like Amper Metal support this perspective.

- However, precedent also exists where national courts assess the necessity of expenses, as seen in Iberdrola and Mitteldeutsche Hartstein, with recent judgments reinforcing this approach by evaluating if provisions like free services are “limited to what was necessary.”

- A rebuttable presumption in favor of the taxpayer could clarify that businesspeople, knowing their operations best, should decide expense necessity, reducing disputes with tax authorities over cost reasonableness.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases