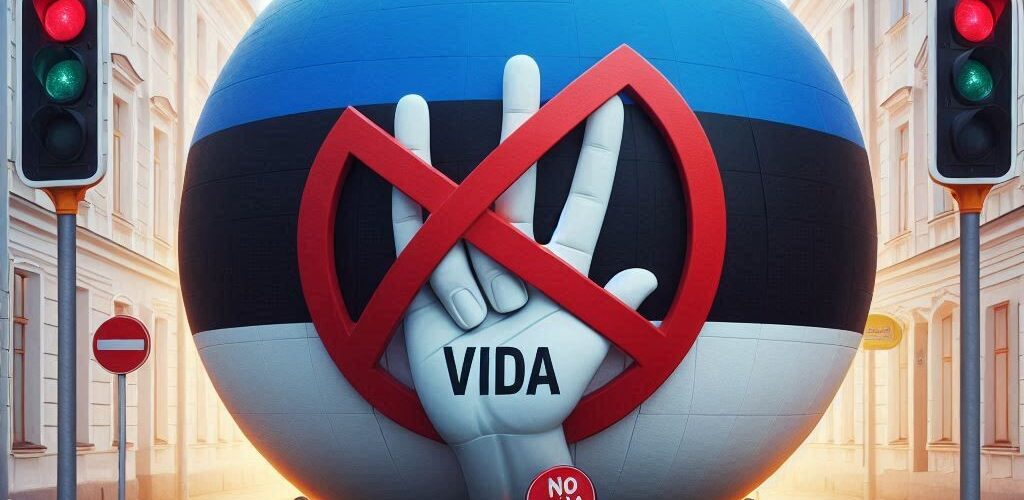

The ViDA initiative has not been agreed upon due to Estonia’s opposition to the proposed reform of VAT in the digital age. Estonia argues that the new regime would unfairly tax small and medium-sized businesses. The European Commission’s proposed measures include digital reporting requirements, addressing challenges of the platform economy, and reducing VAT registration requirements. The timeline for implementation remains unconfirmed, and Estonia has expressed concern about the platform economy pillar.

Source Edicom

Latest Posts in "European Union"

- EPPO Uncovers €11.3M Customs Fraud in Antwerp Steamboat Probe; Three Arrested

- EU Approves Updated E-Invoicing Standard EN 16931-1 for B2B and 2030 Digital Reporting

- EU Imposes New Antidumping Duties on Imports from Russia, USA, Trinidad and Tobago, China

- EU Intrastat Thresholds for 2026: Country-by-Country Updates and Compliance Impacts

- Persistent Tax Barriers and VAT Challenges in the EU Single Market After 30 Years