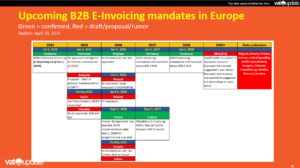

Updated April 29, 2024

Highlights

- Approved B2B E-Invoicing mandates: Romania, Belgium, Germany and France.

- Romania will implement mandatory B2B E-Invoicing as of July 1, 2024. Certain transactions will be subject to E-Reporting as of Jan 1, 2024

- Poland Feb 2026 B2B KSeF e-invoicing mandatory starting Feb 2026

- France has postponed the mandate from July 1, 2024 to Sept 1, 2026 (Big/mid cies & obligation to receive e-invoices) and Sept 1, 2027 (SME’s)

- Spain: VeriFactu Regulation – Computerized Billing System to Combat Tax Fraud as of July 1, 2025.

was targetting to implement madatory B2B E-Invoicing as of July 1, 2024. The implementation will be delayed as the final version of the Royal Decree has not yet been published. Spain does not have the approval yet from the European Commission t implement mandatory B2B E-Invoicing. - Germany: On March 22, 2025, Federal Council approved the E-Invoicing mandate.

- Mandatory invoice receipt obligations by January 2025

- Mandatory e-invoicing for companies with annual turnover over 800,000 Euros by January 2027

- Mandatory e-invoicing for all remaining taxpayers by January 2028

- Belgium: Approved – Mandatory B2B E-Invoicing as of Jan 1, 2026

- Latvian government proposes mandatory B2B E-Invoicing operational by December 30, 2025

- Bulgaria may gradually implement SAF-T as of Jan 1, 2025.

- ViDA will be postponed till most probaly 2030 – 2032. Belgian EU presidency aims to reach an agreement on ViDA on May 14, 2024.

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

Country updates

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

See also

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE