Updated July 23, 2024

Highlights

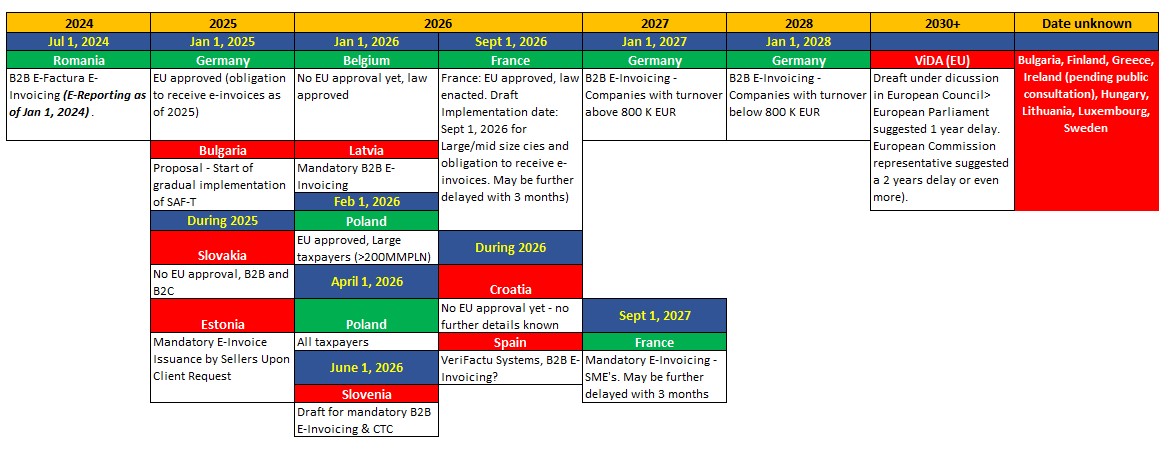

Approved B2B E-Invoicing mandates: Romania, Belgium, Germany, Poland and France.

- Romania will implement mandatory B2B E-Invoicing as of July 1, 2024. Certain transactions will be subject to E-Reporting as of Jan 1, 2024

- Poland Feb 2026 B2B KSeF e-invoicing mandatory starting Feb 2026

- France has postponed the mandate from July 1, 2024 to Sept 1, 2026 (Big/mid cies & obligation to receive e-invoices) and Sept 1, 2027 (SME’s)

- Germany: On March 22, 2025, Federal Council approved the E-Invoicing mandate.

- Mandatory invoice receipt obligations by January 2025

- Mandatory e-invoicing for companies with annual turnover over 800,000 Euros by January 2027

- Mandatory e-invoicing for all remaining taxpayers by January 2028

- Belgium: Approved – Mandatory B2B E-Invoicing as of Jan 1, 2026

Pending

- Latvian government proposes mandatory B2B E-Invoicing operational by December 30, 2025

- Bulgaria may gradually implement SAF-T as of Jan 1, 2025

- Spain: Postponed till 2026

- Estonia’s Proposed Legislation: Mandatory E-Invoice Issuance by Sellers Upon Client Request as of Jan 1, 2025

- Slovenia – Proposal to Introduce Mandatory B2B e-Invoicing Published

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

Country updates

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

See also

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE