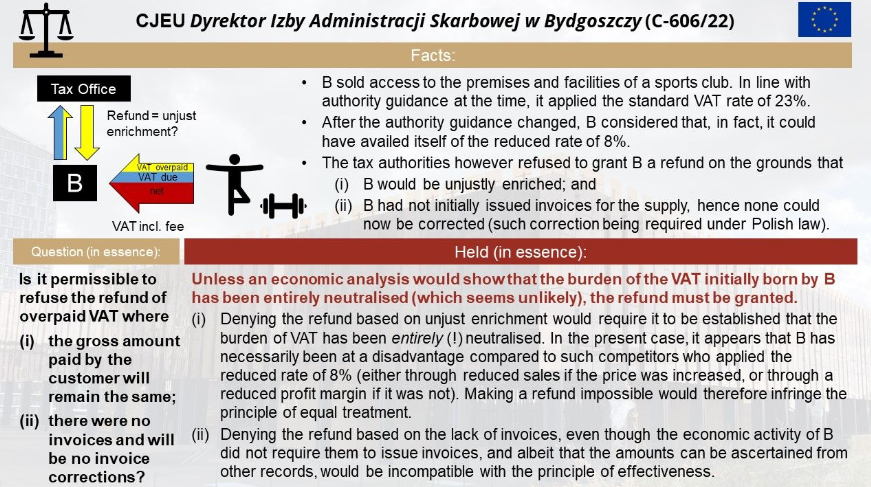

- Tax authorities can deny a refund of overpaid VAT on the ground of unjust enrichment.

- Under EU law, the issue is complex and has been misunderstood by tax officers, legal advisors, and courts.

- However, it has been authoritatively stated that unjust enrichment in a B2C scenario is virtually impossible.

- This is because the supplier will always suffer, either by losing sales if they increase prices to account for higher VAT, or by losing profits if they cannot increase prices.

- The only exception is if all suppliers of a product with inelastic demand make the same mistake, which is very rare in practice.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases