The European Commission provided an update on e-invoicing at the OpenPeppol general meeting in Brussels on November 3, 2022. Interesting different perspectives from various different departments – including policy (DG Grow), the systems side (DG DIGIT) and high level overview of the tax legislative proposals under VAT in the Digital Age (DG TAXUD).

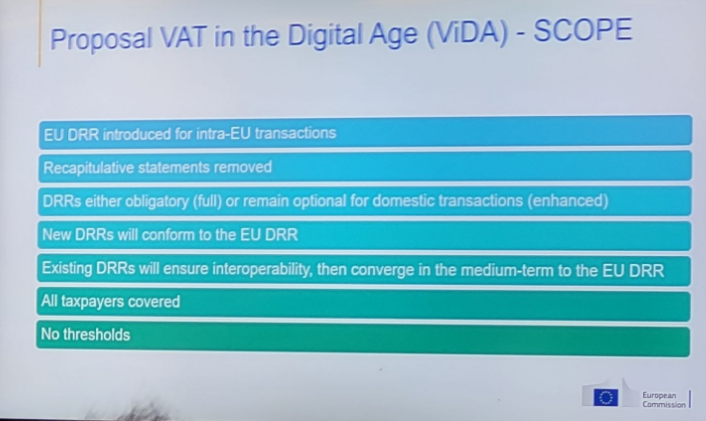

The European Commission will issue on December 7, 2022 its proposal on VAT in the Digital Age, which will include a proposal on Digital Reporting Requirements (DRR). We published a series of newsitems to bring you up-to-speed, click HERE

Posts on Linkedin

- Ellen Cortvriend – ”moving towards an intra-EU reporting system based on the European Norm”

- Axel Baulf – ”a single new cross-border requirement leveraging the European e-invoicing standard (EN 16931)”

- Thierry Amadieu – ”DGTaxud will implement DRR as mandatory interoperability framework for eReporting of intra EU transactions aiming to a convergence at mid term”

Latest Posts in "European Union"

- EU Parliament Approves CBAM Reforms: New 50-Ton Threshold, Delayed Certificate Purchases to 2027

- ViDA: Transforming EU VAT with Harmonized e-Invoicing and Real-Time Reporting

- EU Court Ruling on Arcomet: Transfer Pricing Adjustments Pose VAT Risks for Companies

- Italian Tax Authorities Remove Non-EU Companies from VIES for Failing New VAT Guarantee Requirements

- Comments on ECJ C-121/24: Non-payment of declared VAT does not constitute VAT fraud