The guide explains the tax treatment when selling goods from tax warehouses located at airports to people traveling from Finland outside the EU or to another EU country, as well as to travelers arriving in Finland and domestic tourists. The instructions also discuss the application of the tax storage procedure for sales on ships and aircraft and for equipping these ships.

The instruction replaces the instruction VH/845/00.01.00/2020 issued by the Tax Administration on January 15, 2021 . Sections of the instruction 4.1. and 4.4. has been updated due to the law amendment 134/2022 that entered into force on February 25, 2022. It is also possible to sell goods from the tax warehouse to private travelers arriving in Finland or traveling in Finland.

1 Common

This guide discusses the tax warehouse referred to in the Value Added Tax Act (AVL) and the value added taxation of goods placed in the tax warehouse procedure. The sale, importation and community procurement of goods transferred to the tax warehouse are VAT-free transactions. In addition, the sale of goods transferred to the tax warehouse and the sale of services aimed at the goods in the tax warehouse are VAT-free.

In addition to the tax storage procedure referred to in this instruction, some other storage procedures also have VAT implications. Other warehouses are customs warehouse, excise warehouse, temporary warehouse and free zone.

The customs warehouse applies to goods leaving or coming from outside the EU (Article 240 of Council Regulation (EEC) No. 952/2013 on the Community Customs Code (Customs Code). The customs warehousing procedure is therefore related to goods under import or export procedure and cannot be applied to Community goods.

In the tax-free warehouse referred to in the Excise Taxation Act (182/2010), goods subject to the Excise Taxation Act are stored on which no excise tax has been paid (Section 22 of the Excise Taxation Act).

Goods imported from countries outside the EU that are not immediately cleared by customs can be placed in temporary storage. However, customs clearance must be completed within a certain time limit, which varies depending on the method of transport of the goods (Articles 144–150 of the Customs Code 952/2013).

A free zone is an area separated from the rest of the customs territory of the EU, where non-Community goods are considered to be outside the customs territory of the EU (Articles 243-249 of the Customs Code 952/2013).

Due to the non-taxability of the tax warehousing procedure discussed in this guide, community goods are in the same VAT status as goods imported from outside the EU, which are placed in the aforementioned procedures.

2 Tax warehouse

2.1 Application of the tax storage procedure

Goods in tax warehousing means goods in tax warehouse that are not in customs warehousing or temporary storage (AVL 72j §1 subsection). Both goods imported from outside the EU and goods originating from Finland or other EU regions can be placed in the tax warehousing procedure.

The tax storage procedure applies to the goods listed separately in Section 72i of the AVL. AVL’s list is exhaustive. The tax warehousing procedure ends if the goods are processed in the tax warehouse into some other goods in such a way that they can no longer be considered goods listed in section 72i of the AVL. The goods in the list and their degree of processing are defined by EU customs tariff headings and CN codes. The following goods can be placed under the tax storage procedure:

- tin

- copper

- zinc

- nickel

- aluminum

- lead

- indium

- grain

- oil seeds and oil fruits, coconuts, brazil nuts, cashew nuts, other nuts and olives

- grains and seeds

- unroasted coffee

- tea

- cocoa beans, whole or ground, raw or roasted

- raw sugar

- rubber, preforms or slabs, sheets or strips

- villa

- chemicals in bulk

- mineral oils (including propane and butane; also including petroleum crude oils); headings 2709, 2710, 2711 12 and 2711 13;

- silver

- platinum

- potatoes

- vegetable oils and fats and their fractions, both refined and unrefined, but not chemically modified

- cellulose

The tax warehousing procedure can also include goods that are intended to equip aircraft and watercraft in international traffic or for sale on such aircraft and watercraft or to be sold in a duty-free goods store located at the airport (AVL 72 i § 2 subsection). This is discussed in more detail in chapters 4 Tax warehouse located at the airport and 5 Application of the tax warehouse procedure to sales to watercraft and aircraft.

The tax warehousing procedure is not applicable to goods that are intended to be used in the warehouse or to be sold at the retail stage, i.e. to be sold from the warehouse directly to consumption. An exception to the above is a tax-free goods store located at the airport, for which the entrepreneur can apply for a tax warehouse permit. If a tax warehouse permit has been applied for store premises, the tax-free goods store can sell goods directly from the tax warehouse for consumption.

2.2 Keeping a tax warehouse

2.2.1 Establishing a tax warehouse

Keeping a tax warehouse requires a permit, which is granted on the basis of an application. The permission to keep the warehouse is given by the Tax Administration. The application must be submitted electronically. The tax administration can only accept the submission of an application in another way for a special reason (AVL § 72k subsection 1). A floor plan of the warehouse must be attached to the permit application.

A trader can be accepted as a warehouse keeper who, in terms of his financial circumstances and otherwise, is suitable (AVL § 72k subsection 2). The warehouse keeper can be, for example, the manufacturer, seller, buyer, importer or independent warehouse keeper of the goods. If necessary, the Tax Administration can require the warehouse keeper to guarantee the payment of the tax.

The permit for the tax warehouse is valid from the date the permit is issued. The tax warehouse permit is an appealable decision, which can be appealed to the tax adjustment board (OVML § 59 and § 60). A license for tax storage can be revoked if the conditions for the license no longer exist or if the license conditions have not been complied with (AVL § 72k subsection 3). However, a simple name change, where the entrepreneur’s y-identifier remains the same, does not cause a change in the warehouse keeper.

2.2.2 Inventory accounting

The tax warehouse keeper must keep inventory records that reliably show the goods that have entered the warehouse and the goods that have been taken out of the warehouse. The goods must be stored in such a way that they can be easily inventoried if necessary.

Both goods that are subject to the tax storage procedure and goods that are not affected by this procedure can be stored in the same space. Goods in the tax storage procedure and other goods stored in the same space must, however, be kept physically separate. To keep things separate, it is sufficient, for example, to store goods on different shelf levels or in areas marked as separate. In warehouse accounting, the goods in the tax storage procedure must also be kept separate from other goods.

2.2.3 Statement on placing the goods in the tax warehouse

The warehouse keeper must give a free statement about the placing of the goods in the tax warehouse or the existence of the goods in the tax warehouse to the importer of the goods, the seller of the goods, the community supplier, the person performing the work on the goods in the warehouse and others in need. The statement must show that it is about the goods to be delivered to the tax warehouse or that are there, as well as the quality and quantity of the goods.

2.2.4 Goods subject to excise duty

Goods subject to excise duty are considered to be in the tax warehousing procedure referred to in the Value Added Tax Act when they are in the excise duty warehouse referred to in the Excise Tax Act (AVL 72 j § 2 subsection). However, the tax storage procedure cannot be applied to all goods subject to excise duty. The goods must be mentioned in the list of section 72 i subsection 1 of the VAT Act or the goods must be goods referred to in subsection 2 of the same provision. These goods are also listed in section 2.1 Application of the tax warehousing procedure.

For those goods subject to excise duty, to which the tax warehousing procedure can be applied, an excise duty-free warehouse permit issued according to the Excise Tax Act is sufficient. If there are goods in the tax warehouse other than those subject to excise duty, which you want the tax warehousing procedure to apply to, you must apply for a permit from the Tax Administration for keeping the tax warehouse referred to in the Value Added Tax Act.

3 Goods and related services

3.1 Transferring the goods to the tax storage procedure

No value added tax is charged on the sale, importation or corporate procurement of goods transferred to the tax warehousing procedure (AVL § 72h § 1 subsection 2, AVL § 72h § 4 subsection). The goods transferred to the tax storage procedure must always be purchased without value added tax. The tax warehouse keeper cannot transfer the goods he bought with VAT to the tax warehouse procedure. If the tax warehouse keeper receives a VAT invoice from the seller of the goods and has acquired the goods for the tax warehousing procedure, the tax warehouse keeper must request a new tax-free invoice from the seller.

Although no value added tax is paid for the transfer of the goods to the tax storage procedure, other taxes, fees or payments may apply to the goods. For example, imported goods transferred to the tax warehousing procedure must be cleared by customs. In addition, customs related taxes and fees must be paid. More information on the import value added tax procedure can be found in the Tax Administration’s instructions on the import value added tax procedure from January 1, 2018.

As proof of tax-free sale, importation or community procurement, the seller, importer and community procurer must have a statement from the tax warehouse keeper in their accounting that the goods have been transferred to the tax warehouse. In paragraph 2.2.3. The report on placing the goods in the tax warehouse is discussed in more detail with the content of the report. The seller of the goods has the right to deduct the value added tax on the acquisitions that relate to the value added tax-free sale of goods transferred to the tax warehouse (AVL § 131 subsection 1 point 1).

When the goods and the tax warehouse are located in Finland, the sale of the goods to be transferred to the tax warehouse is reported in the tax declaration under the turnover subject to 0 tax rate. Reporting is not affected by whether the buyer is Finnish or foreign (see example 1)

Example 1: Sale of goods to be transferred to tax warehouse

The Finnish company FI sells the goods to the German DE. The goods are delivered to a tax warehouse located in Finland. Sales are VAT-free. The seller declares the sale with a VAT declaration in the section turnover subject to 0 tax rate.

When goods are delivered from another EU country to a tax warehouse located in Finland directly in connection with a community purchase, the value of the community purchases is reported on the tax return in the section Purchases of goods from other EU countries. In the section Tax on purchases of goods from other EU countries, nothing is reported. If the buyer is a foreigner, he or she must register in Finland as a minimum reporting obligation (see example 2).

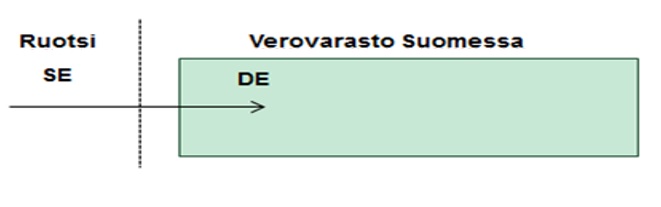

Example 2: Community procurement of goods to be transferred to the tax warehouse

Swedish company SE sells goods located in Sweden to German DE. The goods are delivered to a tax warehouse located in Finland. The buyer declares the community purchase with a VAT declaration under Purchases of goods from other EU countries.

When the goods are delivered from outside the EU to a tax warehouse located in Finland, the basis of the import tax is stated in the tax return under Imports of goods from outside the EU. VAT is not calculated for imports. Under Tax on goods imported from outside the EU, EUR 0.00 is reported (see example 3).

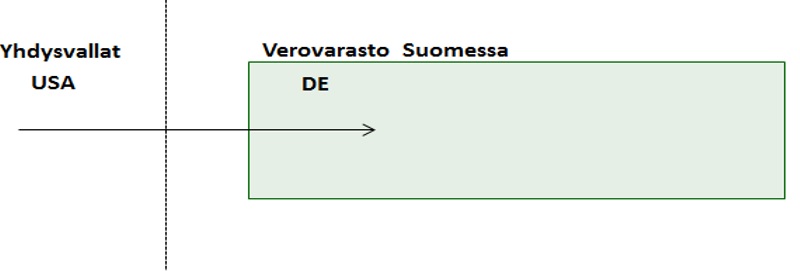

Example 3: Import of goods to be transferred to a tax warehouse

The US company USA sells goods located in the US to the German DE. The goods are delivered to DE to a tax warehouse located in Finland. DE is registered in the VAT register in Finland. DE declares the import in the tax declaration only in the section Imports of goods from outside the EU.

3.2 Sale of goods in a tax warehouse

No tax is payable on the sale of goods that are in the tax storage procedure when the goods are not moved out of the tax warehouse in connection with the sale (AVL 72 h section 1 subsection 4). In this case, it is a sale in a tax warehouse. The seller declares the sale in the tax warehouse with a tax declaration as a sale under the 0 tax rate. Purchases possibly related to the sale are deductible.

In the aforementioned situation, the foreign seller does not have the obligation to register in Finland’s VAT register. In practice, only those sellers are exempted from the registration and notification obligation who trade in goods already in tax warehouse in Finland, which are not moved out of Finland in connection with the sale in question (see example 4).

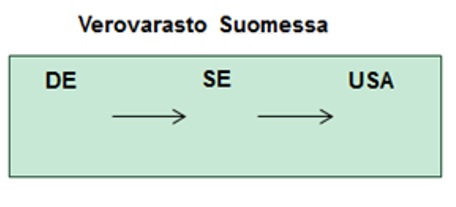

Example 4: The goods do not leave the tax warehouse when sold

The German company DE sells the goods in the tax warehouse to the Swedish SE, which sells them on to the US company USA. The goods do not leave the tax warehouse. Both sales are VAT-free. Companies are not required to register in Finland.

No tax is paid on the sale of goods that are in the tax warehousing procedure in a situation where the goods are moved from one tax warehouse located in Finland to another in connection with the sale (AVL § 72j subsection 3, § 72h § 1 subsection 4). In that situation, the goods are considered to remain in the tax warehouse procedure, even if the goods physically move to another tax warehouse. The seller declares the sale in the tax warehouse with a tax declaration as a sale under the 0 tax rate. The foreign seller does not have the obligation to register in Finland’s VAT register (see example 5).

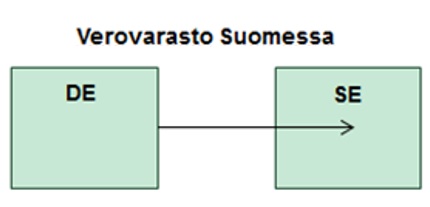

Example 5: Goods are sold from one tax warehouse to another

The German company DE sells goods that are in tax storage in Finland to the Swedish SE. The goods are delivered to another tax warehouse located in Finland. Sales are VAT-free. The seller is not required to register in Finland.

3.3 Service for goods

Tax does not have to be paid on the sale of services for goods in a tax warehouse, if the services are performed in a tax warehouse (AVL § 72h subsection 1 point 5). Services aimed at goods mean e.g. testing, cleaning and repair. Valuation of goods, unloading, loading and storage are also tax-free. If the service aimed at the goods in the tax warehouse refines the goods or changes them into something else in such a way that the goods are no longer goods referred to in section 1 of AVL 72i, the tax warehousing procedure is deemed to end. For example, combining different types of tea is not the kind of processing that would change the goods into something other than tea as referred to in § 72i subsection 1 of the AVL.

However, the transport of goods to or from a tax warehouse is not tax-free, for example, because the service in question is not performed exclusively in a tax warehouse. The transport of goods between tax warehouses located in Finland is also not tax-free, even if the goods remain in the tax warehouse procedure at all times.

4 Tax warehouse located at the airport

4.1 General

In certain situations permitted by the VAT Act, the tax storage procedure can also be applied in the retail stage, i.e. to goods sold directly for consumption. The tax warehousing procedure can be applied to goods that are intended to be sold from a duty-free goods store located at the airport (AVL § 70b subsection 3). At the airport, the tax storage procedure can be applied:

- for goods that are sold as carry-on luggage for travelers outside the EU (AVL § 70b subsection 3).

- for goods that are sold as carry-on luggage for travelers to another EU country (AVL § 72i subsection 2).

- for goods that are sold as carry-on luggage to travelers returning to Finland or domestic tourists traveling in Finland (AVL § 72i subsection 2)

In practice, an entrepreneur operating at the airport can apply for a tax warehouse permit not only for the actual storage space, but also for the store premises. In this case, the goods on display in the store that meet the requirements for the tax storage procedure are also in the tax storage procedure. In the store, which is subject to the tax storage permit, you can also sell other goods that are not subject to the tax storage procedure. The holder of a tax warehouse permit must ensure that the goods in the tax warehouse procedure and the goods that are excluded from the procedure are stored physically separately. The storage of goods is discussed in more detail in chapter 2.2.2 Stock accounting. Such goods that have been acquired as fixed assets of the airport store cannot be placed in the tax storage procedure.

Goods bought in a tax warehouse located at the airport are not subject to import or community acquisition value added tax when the goods come from outside the EU or from another EU country. However, the trader does not avoid possible other obligations, such as customs clearance of goods imported into the country and related taxes and fees.

Correspondingly, when goods are purchased for the tax warehouse from a seller liable for VAT in Finland, the trader must give the seller of the goods a report on the transfer of the goods to the tax warehouse. Based on the report, the seller must sell the goods transferred to the tax storage procedure without VAT.

4.2 Sales from Finland to travelers outside the EU

A trader who sells goods in a tax warehouse located at the airport to a person traveling outside the EU does not pay value added tax on the sale (AVL § 70b subsection 3).

With the tax declaration, the company declares the turnover subject to the 0 tax rate in the tax-free sales section. To a person whose domicile is in Norway, only alcoholic beverages, tobacco products, chocolate and confectionery products, perfumes, cosmetics and toilet products can be sold tax-free (AVL § 70b subsection 3).

4.3 Sale to a person traveling from Finland to another EU country

A trader who sells goods in a tax reserve located at the airport to a person traveling from Finland to another EU country must pay VAT on the sale. In paragraph 4.2. the intended tax exemption applies only to the sale of goods from the tax warehouse to persons traveling outside the EU.

With a tax declaration, the trader informs the person traveling from Finland to another member state of the sale in the section tax on domestic sales, allocating the sale to the correct tax rate.

4.4 Sales to travelers arriving in Finland and domestic tourists

A trader who sells goods in a tax warehouse located at the airport to domestic tourists arriving in Finland and traveling in Finland must pay value added tax on the sale. The procedure is therefore the same as when goods in a tax warehouse are sold to a person traveling from Finland to another EU country.

With a tax declaration, the trader informs the person arriving in or traveling to Finland of the sale in the tax on domestic sales section, allocating the sale to the correct tax rate.

5 Application of the tax warehousing procedure to sales of vessels and aircraft

5.1 Sales to water vessels

The tax warehousing procedure can be applied to goods that are sold for sale on water vessels in professional international traffic (AVL § 72i subsection 2). The goods may be intended for use on the ship during the trip or they may be sold on these ships as goods to be taken in luggage.

In addition, the tax warehousing procedure can be applied to goods that are sold to equip water vessels in international traffic. Goods sold to equip ships include, for example, fuel, maintenance and other similar necessary goods (AVL § 72i subsection 2).

In order for the aforementioned vessels to be in international traffic as defined by the VAT Act, their traffic must be directed outside the EU or to another EU country. On the other hand, goods sold to equip water vessels in domestic traffic can only be placed in the tax warehousing procedure if the goods are mentioned in section 72i subsection 1 of the Value Added Tax Act. A list of these goods is presented in paragraph 2.1.

5.2 Sales to Aircraft

The tax warehousing procedure is also applicable to goods that are sold for sale on aircraft in professional international traffic (AVL § 72i subsection 2). The goods may be intended for use on the ship during the trip or they may be sold on these ships as goods to be taken in luggage. Aircraft are in international traffic when their traffic is directed outside the EU or to another EU country.

In addition, the tax storage procedure can be applied to goods that are sold to equip aircraft (AVL § 72i subsection 2). In terms of equipment, the prerequisite for applying the tax warehousing procedure is that the goods are sold to a trader who, for a fee, mainly engages in international air traffic. The tax warehousing procedure can therefore also be applied to equip an aircraft departing for a domestic flight, as long as the domestic air carrier is primarily a business operator engaged in international air traffic. Air traffic is mainly international when more than 50% of the flights are flown outside of Finland.

6 Termination of the tax warehousing procedure

The tax warehousing procedure ends when the goods leave the tax warehouse and do not move to another tax warehouse (AVL § 72m subsection 1). The obligation to pay the tax arises when the goods are moved out of the tax storage procedure (AVL § 72m subsection 2). The removal of the goods from the tax warehouse can be related, for example, to taking the goods to one’s own use, to the domestic sale of the goods, community sales, export, import, or to the fact that the goods are processed in such a way that they can no longer be considered as goods mentioned in the list of section 72i subsection 1 of the AVL.

For example, when a trader transfers raw material in tax warehouse to his manufacturing operations, the tax warehouse procedure ends and VAT must be paid on the transfer. The tax is reported on the tax return under tax on domestic sales by tax rate. If the raw material is used by the owner of the goods for a deduction, he also declares the tax to be deducted for the target period in the tax to be deducted section (see example 6).

Example 6: Taking the goods for personal use

The Finnish FI takes the raw material located in the tax warehouse in Finland for its own use in its factory located in Finland. The tax storage procedure ends when the raw material is moved out of the tax warehouse and at the same time the obligation to pay the tax arises. FI declares the tax on the transfer of raw material out of the tax warehouse in the tax return under Tax on domestic sales. Since the raw material will be used for a deduction, FI also declares the tax to be deducted in the section Deductible tax for the tax period.

If the transfer of goods is related to the sale, import or transfer of goods outside the EU, the transfer itself out of the tax warehouse is not taxed.

The end of the tax warehousing procedure is then taxed on the basis of the sale, import or transfer of the goods outside the EU (AVL § 72 l subsection 2). Therefore, the sale of goods can be tax-free or tax-free. The tax treatment depends on where the goods are sold (see examples 7 and 8).

Example 7: Sale from tax warehouse

Suomalainen FI Oy sells goods located in a tax warehouse in Finland to Finnish FI Ab. The goods leave the tax warehouse and remain in Finland. The sale is a taxable sale. With the tax return, FI Oy declares the sales tax under Tax on domestic sales.

Example 8: Community sale from tax warehouse

The US company USA sells the goods in the tax warehouse in Finland to the Dutch NL. The goods are delivered from a tax warehouse located in Finland to the Netherlands. The sale is a tax-free community sale. With the tax declaration, the USA declares the sale under Sales of goods to other EU countries. A US citizen must register at least as a reporting obligation in Finland.

7 Basis of tax and responsibility for payment of tax

The person liable to pay VAT on the transfer of goods is the one who causes the end of the tax warehousing procedure (AVL § 72m subsection 1). The tax warehouse keeper is also responsible for the tax to be paid on the transfer (AVL § 72m subsection 3). However, according to the judgment of the EU court in case C-499/10 (Vlaamse Oliemaatschappij NV v. FOD Financiën), the tax warehouse keeper is not jointly and severally liable for the tax if he has acted in good faith or it cannot be proven that he acted incorrectly or was guilty of negligence.

The basis of the tax on the transfer of goods is formed in such a way that the same amount of tax is paid as would have accrued to the state without the tax warehousing procedure. In practice, this means that the transferor of the goods is obliged to pay tax on the amount that would have been paid for the importation, sale or community acquisition, if the goods had not been placed in the tax storage procedure. If services have been applied to the goods during the tax warehousing procedure, the transferor of the goods must pay the taxes that would have had to be paid for the services if the goods had not been in the tax warehouse.

When the transferor of the goods has already acquired the goods in the tax storage procedure free of tax, the value of the last tax-free sale is used as the basis for the tax. The value of tax-free services performed after the last tax-free sale is added to the tax basis.

Source: vero.fi