To move to the right, right click mouse on the table and sweep to the right

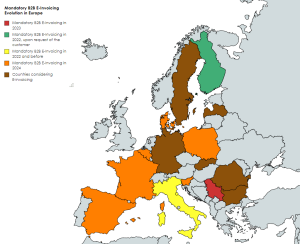

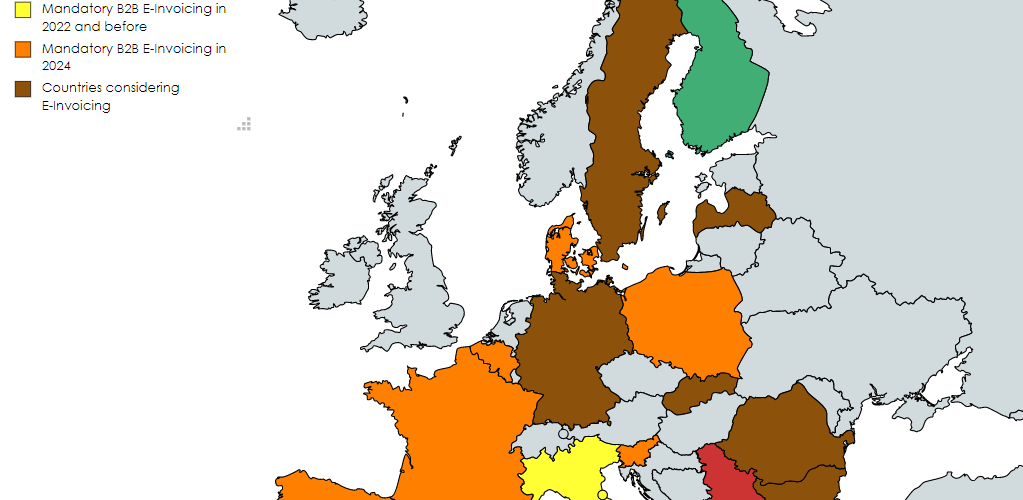

| Belgium | Draft | Gradual implementation of mandatory B2B E-Invoicing as of mid 2024? | |

| Bulgaria | Public consultation on mandatory B2B E-invoicing | ||

| Denmark | As of Jan 2024 | Approved | Mandatory B2B E-Invoicing implemented via Bookkeeping Act |

| France | As of July 1, 2024 | Approved | Mandatory B2B E-invoicing/Real Time Reporting |

| Germany | New coalition agrees on implementation E-Invoicing and Real Time Reporting | ||

| Hungary | Late 2022/Early 2023 | SAFT implementation late 2022/early 2023 | |

| Italy | July 1, 2022 | Mandatory Electronic invoicing scheme between Italy and San Marino | |

| Italy | July 1, 2002 | FatturaPA for cross-border invoice and abolishment Esterometro delayed till July 2022 | |

| Latvia | Draft – 2025 | Mandatory B2B and B2G | |

| Luxembourg | By 2023 | Mandatory B2G E-Invoicing | |

| Poland | Optional as of Jan 2022, Mandatory as of 2024(?) | Optional B2B E-Invoicing as of Jan 2022, mandatory as of Jan 2024? | |

| Portugal | 2022/2023 | ATCUD (delayed till 2023) and QR codes (Jan 1, 2022) obligatory invoice elements | |

| Romania | As of Dec 1, 2021 | eFactură electronic invoices registration as of Nov 1, 2021, mandatory application of B2B E-Invoicing and Real Time Reporting for high risk products as of July 2022 | |

| Romania | AS of July 2022 | July 2022 for large taxpayers, Jan 2023 for medium and 2025 for small paxpayers and non-residents | |

| San Marino | Oct 1, 2021 – Jully 2022 | E-invoice Requirement for Companies Selling Goods in Italy, voluntary Oct 1, 2021, Mandatory as of July 2022 | |

| Slovakia | As of Jan 1, 2023 | Draft | Mandatory B2G, G2G, and G2B E-Invoicing and Real Time Reporting as of Jan 1, 2023. B2B and B2C will follow in a later phase. |

| Slovenia | Plans to introduce B2B E-Invoicing | ||

| Spain | Jan 1, 2024 | Draft | Mandatory B2B E-Invoicing |

| Sweden | Consider SAF-T, VAT notification, Real Time Reporting, E-Invoicing – No concrete plans |