To support micro-businesses, an annual EUR 10 000 turnover threshold has been introduced as from 1 January 2019, up to which the place of supply of TBE services to consumers in another Member State remains in the Member State where the supplier is established.

As of 1 July 2021, this threshold covers cross-border supplies of TBE services and intraCommunity distance sales of goods but not supplies of other types of services carried out to customers in the EU. The threshold is calculated by taking into account the total value of cross-border TBE services and intra-Community distance sales of goods and applies both to suppliers and to deemed suppliers.

Consequently, cross-border supplies of TBE services and intra-Community distance sales of goods will be subject to VAT in the Member State where the supplier is established if the following conditions are met (Article 59c(1)):

1. the supplier is established, has his permanent address or usually resides in only one Member State;

2. he supplies TBE services to customers who are established, have their permanent address or usually reside in another Member State or he makes intra-Community distance sales of goods and dispatches or transports those goods to another Member State than the Member State where he is established;

3. the total value of these supplies of TBE services and intra-Community distance sales of goods made to consumers in other Member States does not exceed EUR 10 000 (exclusive of VAT) in the current and in the preceding calendar year.

This means that supplies of cross-border TBE services and intra-Community distance sales of goods up to EUR 10 000 will have the same VAT treatment as domestic supplies.

However, the supplier may decide not to apply the EUR 10 000 threshold and to apply the general place-of-supply rules (e.g. taxation in the Member State of the customer in the case of TBE services and the Member State to which the goods are dispatched or transported in the case of intra-Community distance sales of goods). In this situation, he can choose to register for the OSS in the Member State where he is established even if he does not exceed the threshold. In this case, the supplier will be bound by his decision for two calendar years.

In any case, as soon as the annual threshold of EUR 10 000 is exceeded, the general rule applies and VAT will be due in the Member State of the customer for TBE services and the Member State to which the goods are dispatched or transported in the case of intraCommunity distance sales of goods.

This threshold does not apply to:

i) supplies of TBE services made by a supplier not established in the EU (non-Union scheme),

ii) intra-Community distance sales of goods made by a supplier established outside the EU,

iii) distance sales of imported goods (import scheme),

iv) supplies of services other than TBE services,

v) domestic supplies of goods made by a deemed supplier,

vi) supplies of goods by a supplier who is established, has his permanent address or usually resides in more than one Member State.

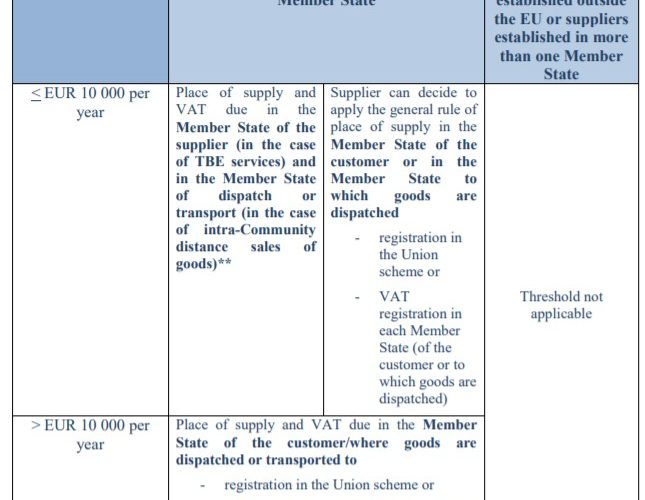

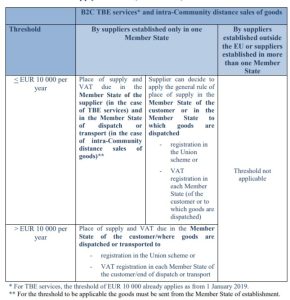

The below table presents the consequences of the application of the EUR 10 000 threshold.

See also