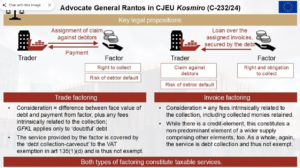

- VAT on Debt Collection Services: Services classified as ‘debt collection’ are subject to VAT, even if they fall under otherwise exempt payment services, while the granting of credits remains exempt without any such specific exclusion.

- Advocate General Rantos’ Opinion: The recent opinion from Advocate General Rantos supports the German Tax Authorities’ position on “invoice factoring,” indicating that it aligns with existing VAT regulations.

- UK VAT Considerations: In the UK, there are complexities regarding the application of debt collection VAT exemptions, as there is no specific carve-out in UK law, and interpretations may extend beyond current legal limits, potentially leading to VAT leakage in trade factoring scenarios when debtors default.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases