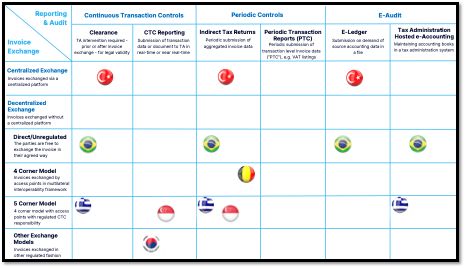

- Introduction of the Classification Matrix: The CIAT has published Version 1.0 of the Classification of Indirect Tax Controls, designed to help stakeholders navigate the complexities of international transactional tax reporting.

- Guide to Diverse Systems: The matrix serves as a pathway through the various models of digital indirect tax controls, helping to highlight similarities and differences among the systems used globally.

- Challenges of Standardization: Christiaan van der Valk emphasizes the difficulty of standardizing tax and government digitalization initiatives due to the varied interpretations of terms like “e-invoicing” across different regions and regulatory environments.

- Facilitating Dialogue: The matrix aims to establish a foundation for productive discussions among taxpayers, tax administrations, and service providers, facilitating better alignment and understanding of indirect tax controls.

- Living Document: As a dynamic resource, the matrix will be regularly updated to reflect changes and incorporate feedback from stakeholders, ensuring it remains relevant and useful in the evolving landscape of tax compliance.

Source Christiaan Van Der Valk

About the initiative

- The Digital Dialogue (DD) initiative has emerged from a previous forum by the International Chamber of Commerce, aimed at fostering open discussions between private companies and tax administrations regarding Continuous Transaction Controls (CTC) principles.

- The DD will be co-chaired by Christiaan Van der Valk, Ana Mascarenhas, and Alexander Kollmann, focusing on the harmonization of practices related to digitalization in tax administration.

- Since the inception of electronic invoicing in Chile in 2003, various countries have adopted different approaches to continuously monitor transactions, particularly regarding indirect taxes, resulting in a wide range of compliance requirements and reporting mechanisms.

- The DD aims to categorize these differing approaches through the CTC Classification Matrix, which distinguishes between reporting systems and clearance models, facilitating better understanding and dialogue among taxpayers, tax administrations, and service providers.

- The matrix seeks to create a common vocabulary and framework for discussing legal regimes, assisting practitioners in navigating current and future tax obligations while promoting potential standardization of tax enforcement laws across regions.

Source CIAT

Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE