- Definition and Purpose: A Reemtsma-claim allows taxpayers to seek recovery of unduly paid VAT from Tax Authorities when they can no longer recover it from the supplier, addressing situations like supplier insolvency or time bars.

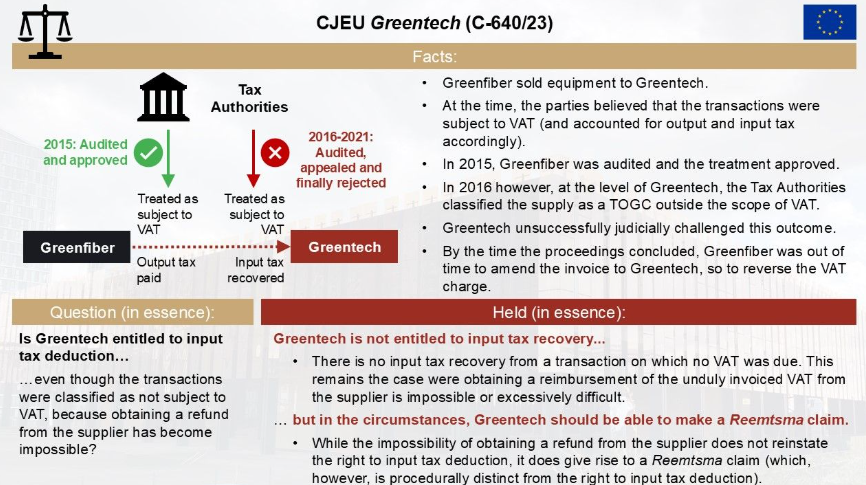

- Recent CJEU Ruling: The Court of Justice of the European Union (CJEU) has expanded the scenarios under which Reemtsma-claims can be utilized, now including cases where a supplier is time-barred from rectifying their VAT obligations.

- Distinct Procedure: The Reemtsma-claim is emphasized as a separate legal procedure from input tax deduction, affecting the timing of claims—input tax deductions are available upon invoice receipt, whereas Reemtsma-claims arise only when recovery from the supplier becomes impossible.

Source Fabian Barth

See also

- ECJ C-640/23 (Greentech) – Judgment – VAT deductions denied if VAT is not due but taxpayers can claim refunds directly

- Flashback on ECJ cases – C-35/05 (Reemtsma Cigarettenfabriken) – No refund of VAT via 8th VAT Directive if not legally due, but ….

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Podcast by Piotr Chojnocki