Listen Here to the Podcast version on Spotify

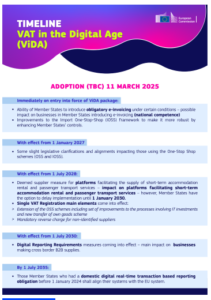

The VAT in the Digital Age (ViDA) package has been adopted on 11 March 2025 following reconsultation of the European Parliament and will be rolled out progressively until January 2035.

Upon entry into force, Member States will be able to introduce mandatory e-invoicing under specific conditions, and improvements will be made to the Import One-Stop-Shop (IOSS) framework for improved controls.

Effective 1 January 2027, minor legislative clarifications will impact users of the One-Stop Shop (OSS) and IOSS schemes. From July 1, 2028, platforms in short-term accommodation rental and passenger transport must comply with new deemed supplier measures, while the Single VAT Registration reforms and mandatory reverse charge for non-identified suppliers will start.

Digital Reporting Requirements will affect cross-border B2B transactions from 1 July 2030. By 1 January 2035, Member States with a domestic digital real-time transaction reporting obligation must align their systems with the EU standards, marking the final phase of this comprehensive ViDA package.

Source ec.europa.eu

Deep dive

Executive Summary:

The EU’s VAT in the Digital Age (ViDA) initiative is a comprehensive effort to modernise and digitalise the Value Added Tax (VAT) system across the European Union. Approved by the Council of the European Union on March 11, 2025, ViDA aims to enhance tax collection, combat fraud, simplify compliance for businesses, and ensure the proper functioning of the internal market in the digital age. The initiative focuses on three key pillars: Digital Reporting Requirements (DRR) through mandatory e-invoicing, addressing VAT challenges in the platform economy (short-term accommodation and passenger transport), and expanding the One-Stop Shop (OSS) for VAT registration. Implementation will occur in stages, starting with immediate changes and extending to 2035.

Key Themes and Information:

1. Rationale and Objectives:

- Outdated VAT Regulations: The current VAT regulations are seen as “outdated and ineffective,” leading to difficulties in tax compliance and revenue loss.

- Significant Revenue Loss: The European Commission estimates that approximately €93 billion in VAT revenue was lost in 2020, with a significant portion attributable to cross-border transactions.

- Primary Objectives: The core aims of ViDA are to:

- “Guarantee an efficient and fair VAT system for the digital economy.”

- “Fight against fraud, especially intra-community fraud.”

- “To ensure the proper functioning of the Internal Market.”

- “Simplify and adapt VAT regulations to the new digital reality of the market to facilitate tax compliance and provide greater legal certainty.”

- “Optimize tax reporting requirements through digitalization.”

2. Three Pillars of ViDA:

- Digital Reporting Requirements (DRR):Focuses on implementing mandatory e-invoicing for B2B intra-EU transactions.

- “This pillar focuses on implementing e-invoicing and establishing digital reporting systems to facilitate the exchange of tax information between EU countries.”

- Aims to standardize e-invoicing processes across member states.

- Key Dates: E-invoicing becomes mandatory for intra-EU B2B and reverse charge transactions from July 1, 2030. National e-invoicing systems (excluding those implemented prior to 2024) must be harmonized by this date. Those earlier systems will be harmonized by 2035.

- Platform Economy: Addresses VAT collection challenges related to short-term accommodation and passenger transport services provided via digital platforms.

- “Starting January 1, 2030 (or optionally from July 1, 2028), The ‘deemed supplier’ rule will be introduced” where platforms will be responsible for VAT collection and remittance.

- Aims to enhance the role of digital platforms in VAT collection.

- One-Stop Shop (OSS) Expansion: Seeks to create a single VAT registration system, simplifying tax administration for businesses operating in multiple EU countries.

- “The third pillar proposes creating a single VAT registration system, enabling businesses to manage their tax obligations throughout the EU with one registration.”

- Will be expanded to include B2C sales of products like electricity or gas within a Member State, and stock movements within the EU intended for later direct sales.

3. Implementation Timeline and Key Dates:

- November 5, 2024: ECOFIN ministers approved the ViDA package.

- March 11, 2025: Council of the European Union reached an agreement on the ViDA reform package.

- 2025 (20 days after ViDA adoption): Approval from the European Commission for domestic e-invoicing will no longer be required.

- January 1, 2027: Updates to the e-commerce package; expansion of OSS to include supplies of electricity, gas, and heat. Platforms facilitating intra-community supplies will be deemed to purchase and supply goods to taxable persons whose acquisitions are exempt from VAT. The call-off stock regime will be phased out between this date and June 30, 2029.

- July 1, 2028: Implementation of a single VAT registration (OSS extension); optional application of the deemed supplier rule for accommodation and mobility platforms. Electronic platforms facilitating short-term accommodation and passenger transport will be deemed to have supplied the services themselves.

- January 1, 2030: Expanded VAT obligations for platforms; mandatory application of the deemed supplier rule for accommodation and mobility platforms.

- July 1, 2030: Mandatory Digital Reporting Requirements (DRR) based on e-invoicing for B2B intra-EU transactions.

- January 1, 2035: Harmonization of domestic e-invoicing systems implemented before 2024 with EU standards.

4. Specific Changes and Measures:

- IOSS (Import One-Stop-Shop): Introduction of a unique transaction number for each IOSS transaction to combat fraud.

- Mandatory Domestic Electronic Invoicing: Member States can mandate e-invoicing without customer consent.

- Supplies by Platforms: From January 1, 2027, platforms facilitating intra-community supplies will be deemed to purchase and supply goods not only to non-taxable persons but also to taxable persons and non-taxable legal entities whose acquisitions are exempt from VAT.

- Call-Off Stock Regime: The current VAT rules for call-off stock will gradually be phased out from January 1, 2027, to June 30, 2029, only applying to stock in place before June 30, 2028.

- Short-Term Accommodation and Transport: From July 1, 2028, electronic platforms facilitating short-term accommodation (up to 30 days) and passenger transport will be deemed to have supplied the services themselves, with certain exceptions.

- Reverse Charge Mechanism: The reverse charge mechanism will shift liability to the taxable customer if the supplier is unregistered in the VAT due Member State.

- Record Retention: Platforms that do not qualify for deemed supply must retain records of transactions for ten years.

- Special Exemption for Small Enterprises: The criteria for determining turnover for the Special Exemption Scheme for Small Enterprises will now include various exempt transactions.

5. Anticipated Benefits:

- Reduced compliance costs: Estimated savings of €4.3 million thanks to pre-filled VAT returns.

- Savings in handling costs: Estimated savings of €1.9 billion in postal shipments alone.

- Increased efficiency of tax control: Through improved risk analysis systems.

- Increased tax collection: Estimated collection of between €135 billion to €177 billion.

- Reduction of tax fraud: Real-time information makes it more difficult for fraudsters.

- Improved cross-border trade: Due to harmonised reporting systems.

6. Impact on Businesses:

- Digital Infrastructure Investment: Businesses will need to invest in digital infrastructure to comply with e-invoicing and reporting requirements.

- Adaptation to New Rules: Companies, especially those using online platforms or involved in cross-border trade, will need to adapt to new VAT collection and reporting rules.

- VAT Number Validation: Member States may require validation of VAT numbers.

7. Legal Texts:

The approved package includes a directive, a regulation, and an implementing regulation. While regulations are directly applicable, the directive must be transposed into national law by each member state.

Conclusion:

The ViDA initiative represents a significant overhaul of the EU VAT system, aiming to address challenges posed by the digital economy and modernise VAT processes. Businesses and Member States alike must prepare for these changes, investing in necessary digital infrastructure and adapting to new regulations to ensure compliance and reap the benefits of a more efficient and transparent VAT system.

Other Sources

See also

Latest Posts in "European Union"

- EU Parliament Approves CBAM Reforms: New 50-Ton Threshold, Delayed Certificate Purchases to 2027

- ViDA: Transforming EU VAT with Harmonized e-Invoicing and Real-Time Reporting

- EU Court Ruling on Arcomet: Transfer Pricing Adjustments Pose VAT Risks for Companies

- Italian Tax Authorities Remove Non-EU Companies from VIES for Failing New VAT Guarantee Requirements

- Comments on ECJ C-121/24: Non-payment of declared VAT does not constitute VAT fraud