- Simplified Compliance for VAT Transactions: The EU’s introduction of the simplified triangulation method under the VAT Directive aims to ease compliance and trade, allowing EU-taxable persons to significantly reduce their VAT reporting burdens in triangular supply chain transactions.

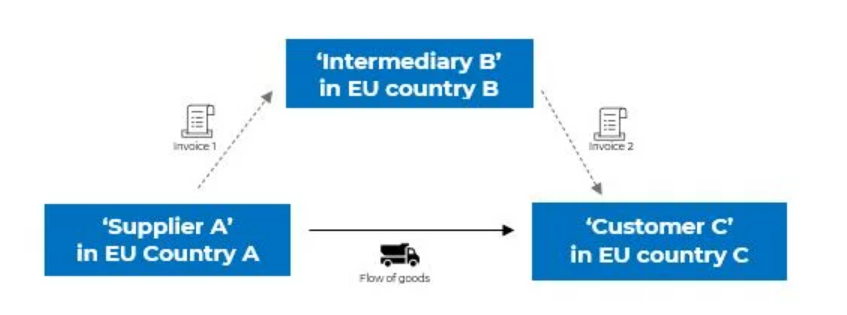

- Transaction Flow: In a typical scenario, goods are sold from one EU VAT-registered supplier to an intermediary, who then supplies them directly to an end customer in a different Member State. The intermediary can use the simplified triangulation method to avoid registering for VAT in the destination country, simplifying the process of reporting intra-community acquisitions.

- Reporting Obligations: The first supplier issues an invoice for a zero-rated intra-community supply, which is reported in their domestic return. The intermediary issues a VAT-exempt invoice to the end customer under the reverse charge mechanism, reporting this transaction as a simplified triangular supply, while the end customer accounts for the transaction in their local VAT return on a self-billing basis.

Source 1stopvat