The case involves a dispute between Tauritus UAB, a company importing goods, and the Lithuanian Customs Department regarding the calculation of Value Added Tax (VAT) due on imported goods. Specifically, the issue arose from the customs valuation method applied to the goods, which affected the amount of VAT and related interest on arrears due to late payment.

Key Facts

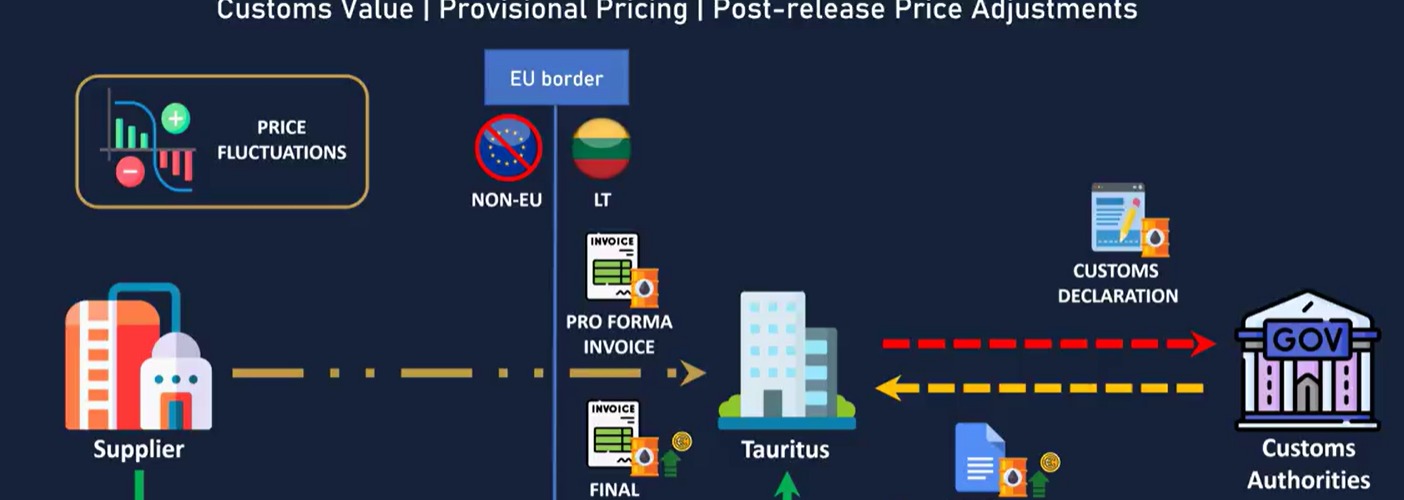

- Tax Inspection: A tax inspection was conducted by the Kaunas regional customs service on Tauritus from October 2015 to April 2017, during which it was discovered that Tauritus imported diesel and fuel, declaring a provisional purchase price as the customs value in its import declarations.

- Provisional and Final Prices: The contracts with suppliers stated provisional prices, which were later adjusted to reflect market conditions and exchange rates, resulting in final prices that could be higher or lower than the initial declarations.

- Declarations and Amendments: Tauritus lodged 13 import declarations indicating the provisional prices but did not adjust these values following receipt of amended invoices that indicated final prices higher than those declared.

- Customs Authority’s Decision: The customs authority determined the customs value based on the final prices from the amended invoices and required Tauritus to pay interest on the VAT arrears from the date of the original declarations.

- Legal Proceedings: Tauritus challenged the customs authority’s decision through various legal channels, ultimately leading to the case being referred to the Lietuvos vyriausiasis administracinis teismas (Supreme Administrative Court of Lithuania) for a preliminary ruling.

Legal Framework

- Union Customs Code (Regulation (EU) No 952/2013): This regulation governs customs procedures within the EU, including the valuation of goods for VAT purposes.

- Customs Valuation: The primary method for determining customs value is the transaction value, which is the price actually paid or payable for the goods. Adjustments may be made if conditions affecting the sale are known but not determined at the time of customs declaration.

- Supplementary Declarations: The customs code allows for simplified declarations (Article 166) and supplementary declarations (Article 167) to be used when dealing with provisional prices, allowing for adjustments once the final price is known.

Questions for Preliminary Ruling

- Applicability of Article 70: The court sought clarification on whether Article 70 of the Customs Code applies when only a provisional price is known at the time of customs declaration, and the final price is determined later based on external conditions.

- Obligation to Amend Customs Value: The court also questioned whether the declarant is obliged to apply for an adjustment of the customs value if the final price becomes known after the goods have been released for circulation.

Analysis

- Transaction Value Method: The analysis emphasized that the transaction value method (Article 70) should apply when conditions affecting the final price are known and can be objectively verified by customs authorities.

- Adjustment Mechanisms: The mechanisms for adjusting customs values were discussed, highlighting that Tauritus should have used a simplified declaration initially and followed up with a supplementary declaration once the final price was established.

- Role of Customs Authorities: The customs authorities retain the power to verify the accuracy of declared values and ensure compliance with customs regulations.

Conclusions

- First Question: Article 70(1) applies in situations where conditions for determining the final price are known and can be verified, even if the price is initially provisional.

- Second Question: Article 173(3) allows for amendments to customs declarations but is not the appropriate mechanism for cases where a supplementary declaration should be filed.

Source

Video from Khalid Abdullah