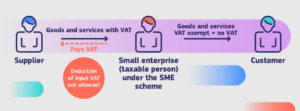

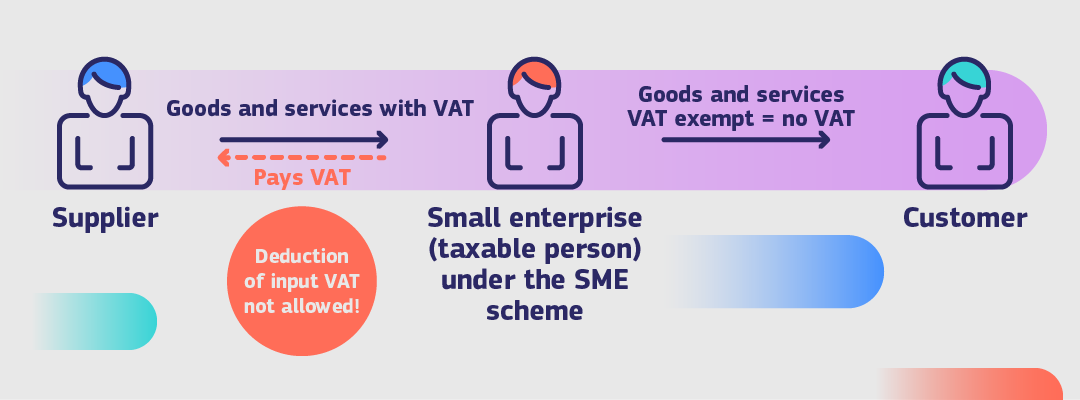

- VAT Exemption for Small Enterprises: Starting January 1, 2025, small enterprises with an annual turnover below EUR 100,000 can sell goods and services without charging VAT, easing compliance burdens.

- Eligibility Criteria: The SME scheme is available to small enterprises in the EU, with a new maximum national annual threshold of EUR 85,000. Non-EU enterprises, including those in the UK, are ineligible.

- Simplified Registration and Reporting: Small enterprises will benefit from a single registration process and will only need to submit one quarterly report, replacing traditional periodic VAT returns.

- Cross-Border Application: Enterprises can apply VAT exemptions on cross-border transactions, ensuring equal treatment for small businesses regardless of their Member State of establishment.

- Exceptions and Conditions: While most goods and services qualify for VAT exemption, specific conditions apply based on whether the enterprise is using the domestic or cross-border SME scheme.

Source ec.europa.eu