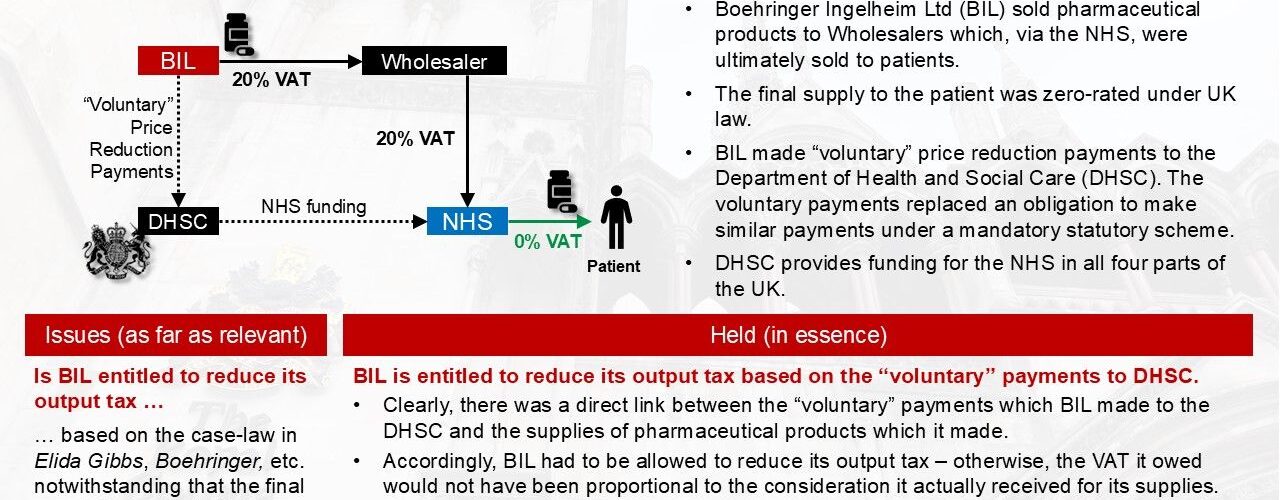

Tribunal Ruling on VAT Principles: The UK First-Tier Tribunal ruled that principles from Elida Gibbs, Boehringer, and Novo Nordisk cases apply even when the final supply in the chain is zero-rated, allowing suppliers to receive refunds on their output VAT.

VAT System Conundrum: This decision creates a discrepancy where the supplier pays 20% VAT on a reduced amount while the wholesaler deducts 20% input tax on the full amount, leading to the state refunding more VAT than it collects.

Implications and Future Review: The ruling could result in the state being out of pocket, prompting interest in how the Upper Tribunal will address the issue if permission to appeal is granted.

Source Fabian Barth

See also

- Rebates paid to UK government by medicines supplier to NHS lead to VAT refund

- Roadtrip through ECJ cases: Focus on Promotional activities/Discounts (Art. 79, 87, 90(1))

- C-462/16 – Boehringer Ingelheim Pharma GmbH & Co. KG – Discounts reduce the VAT value of pharmaceutical supplies

- C-717/19 – Boehringer Ingelheim – Reduction of the taxable amount – Agreement between pharmaceutical company and health insurer

- C-248/23 (Novo Nordisk) – Reduction taxable amount on ex lege payments to the State health insurance agency