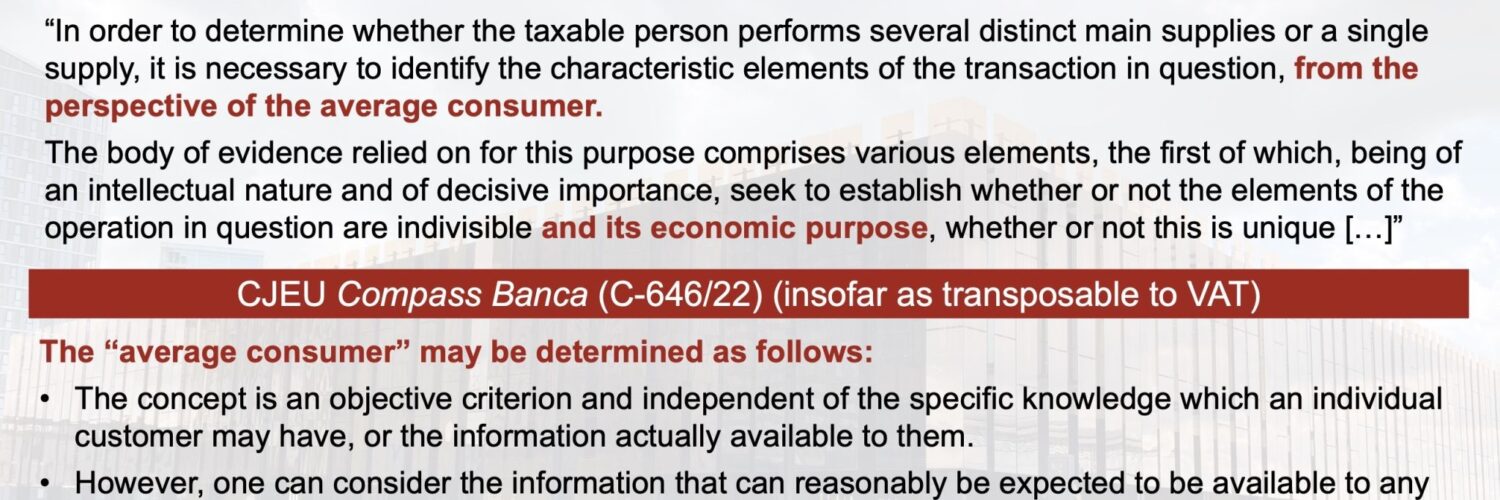

Detailed Explanation of the Concept of ‘Average Consumer’ in Case C-646/22

Context: The concept of the ‘average consumer’ is central to the evaluation of whether a business practice is unfair under EU consumer protection law, specifically Directive 2005/29/EC on unfair business-to-consumer commercial practices.

Key Points from the Case:

- Definition of ‘Average Consumer’:

- The ‘average consumer’ is defined as someone who is reasonably well-informed, reasonably observant, and circumspect.

- This definition is rooted in the principle of proportionality and is meant to reflect a typical consumer’s behavior in the marketplace.

- Objective Criterion:

- The ‘average consumer’ is an objective standard, meaning it does not depend on the specific knowledge or circumstances of the individual consumer involved in a particular case.

- It is not a statistical measure but a legal standard to guide courts and authorities in assessing commercial practices.

- Influence of Cognitive Biases:

- The Court acknowledged that cognitive biases could impair the decision-making capacity of the average consumer.

- Cognitive biases refer to psychological factors that can influence a consumer’s ability to make rational decisions, such as framing effects, where the presentation of information can sway consumer choices.

- Legal Background and Interpretation:

- Recital 18 of Directive 2005/29 emphasizes that the average consumer is someone who is reasonably well-informed and reasonably observant and circumspect, taking into account social, cultural, and linguistic factors.

- The Court’s previous rulings have reinforced this notion, stressing that the average consumer is not overly naive or overly sophisticated but represents a balanced and typical individual in the marketplace.

- Application in the Case:

- In the specific case of Compass Banca, the Court had to determine whether the practice of cross-selling personal loans and unrelated insurance products without a cooling-off period would mislead or unduly influence the average consumer.

- The Court ruled that while the average consumer is expected to be reasonably aware and careful, this does not exclude the possibility that their decision-making could be impaired by cognitive biases.

- Therefore, commercial practices must be examined to ensure they do not exploit these biases to the detriment of consumers.

- Judicial Assessment:

- National courts and authorities must exercise their judgment, considering the typical reaction of the average consumer in specific situations.

- The assessment should account for the context in which the commercial practice occurs and the potential impact on the consumer’s ability to make an informed decision.

Conclusion: The concept of the ‘average consumer’ as articulated in Case C-646/22 is a nuanced standard that balances the need for consumer protection with the recognition of typical consumer behavior. It requires that the average consumer is reasonably well-informed and observant but also acknowledges the potential for cognitive biases to influence decision-making. This standard helps ensure that commercial practices are fair and transparent, protecting consumers from being misled or unduly influenced in their economic decisions.

- Court: Court of Justice of the European Union (Fifth Chamber)

- Date: 14 November 2024

- Reference: ECLI:EU:C:2024:957

- Parties Involved: Compass Banca SpA vs. Autorità Garante della Concorrenza e del Mercato (AGCM), with intervening parties Metlife Europe Dac, Metlife Europe Insurance Dac, and Europ Assistance Italia SpA.

- Legal Context: The case involves the interpretation of Directive 2005/29/EC on unfair business-to-consumer commercial practices and Directive (EU) 2016/97 on insurance distribution.

Key Legal Issues:

- Concept of ‘Average Consumer’: Whether the concept should consider cognitive biases and bounded rationality.

- Aggressive Commercial Practices: Whether cross-selling a personal loan and an unrelated insurance product without a cooling-off period constitutes an aggressive commercial practice.

- National Authority’s Powers: Whether a national authority can impose a cooling-off period to prevent aggressive or unfair commercial practices.

- Directive 2016/97 Compliance: Whether requiring a cooling-off period conflicts with the provisions of Directive 2016/97.

Facts:

- Compass Banca offered personal loans and unrelated insurance products simultaneously, without a cooling-off period between signing the loan and insurance contracts.

- AGCM investigated and deemed this practice aggressive and unfair, imposing a fine on Compass Banca.

- Compass Banca challenged this decision, leading to a request for a preliminary ruling from the Consiglio di Stato (Council of State, Italy).

Court’s Analysis and Rulings:

- Concept of ‘Average Consumer’:

- The Court ruled that the concept of an ‘average consumer’ should be defined as someone reasonably well-informed, observant, and circumspect.

- This definition does not exclude considering cognitive biases that may impair decision-making.

- Aggressive Commercial Practices:

- The Court determined that simultaneously offering a personal loan and an unrelated insurance product does not inherently constitute an aggressive or universally unfair practice.

- Such practices must be evaluated on a case-by-case basis to determine if they involve harassment, coercion, or undue influence.

- National Authority’s Powers:

- The Court held that Directive 2005/29 does not preclude national authorities from requiring a cooling-off period if it is established that the practice is aggressive or unfair.

- However, such measures must be proportionate and less restrictive alternatives should be considered.

- Directive 2016/97 Compliance:

- Article 24(3) of Directive 2016/97 does not prevent national authorities from imposing a cooling-off period to address aggressive or unfair practices.

- The directive requires that consumers have the option to purchase insurance products separately from other services.

Conclusion: The Court provided clarity on the interpretation of consumer protection laws concerning aggressive commercial practices and the role of cognitive biases in defining the ‘average consumer.’ It affirmed the powers of national authorities to impose measures like cooling-off periods to protect consumers, provided these measures are proportionate and justified.

Source

See also