- Jordanian Income and Sales Tax Department posted a list of general sales tax exemptions and incentives

- Fully exempt goods include electric vehicle charging devices and batteries for hybrid EVs

- Fully exempt services include medical expense management services

- Goods subject to a reduced rate include specialized tourist transport vehicles at 10 percent

- Entities subject to a reduced rate include small finance companies at 3 percent

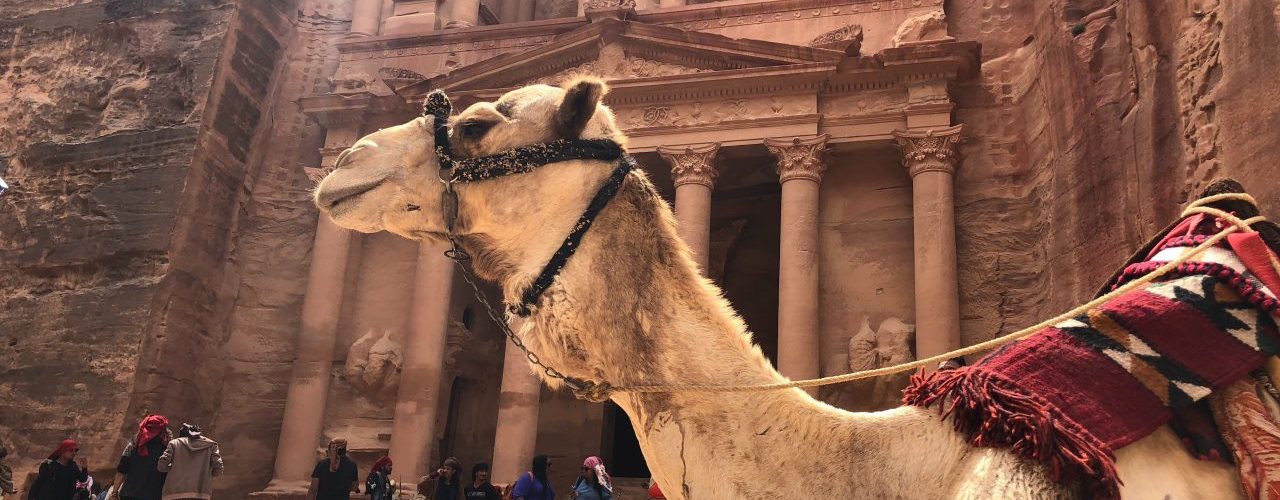

- Incentives on construction materials for specified entities like hotels, tourist facilities, restaurants, and amusement parks

Source: news.bloombergtax.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.