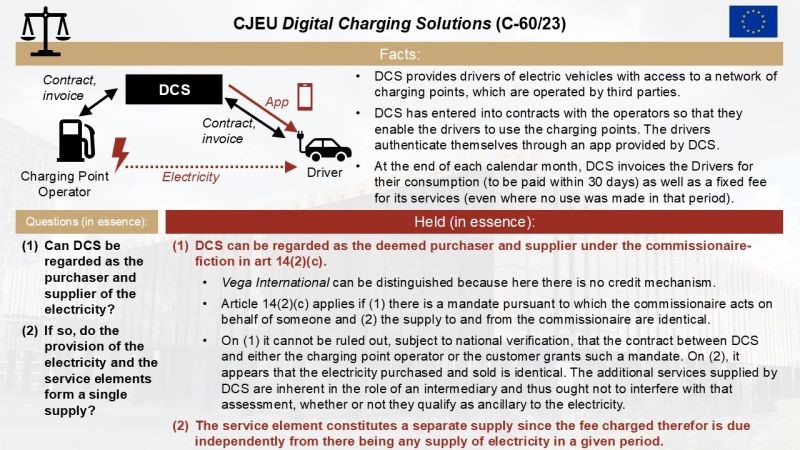

- ECJ’s Treatment of Fuel Cards: The judicial approach to fuel cards at the ECJ has been inconsistent; in the Vega International case, it was determined that an intermediary (fuel card provider) cannot be considered the purchaser of fuel or electricity since the driver retains control over the purchase.

- Application of Article 14(2)(c): Following the Vega ruling, the ECJ appears to support using Article 14(2)(c) as a workaround, allowing intermediaries to act on behalf of the seller or purchaser, though its practical application may depend on contract specifics.

- Potential Flexibility in Interpretation: While the principle from ITH Comercial Timișoara indicates that a mandate is required for intermediaries, the recent judgment hints at a more flexible interpretation, potentially broadening the scope for intermediaries in VAT transactions.

Source Fabian Barth

See also

- C-60/23 (Digital Charging Solutions) – Judgment – Charging electricity for electric vehicles at public points is a supply of goods

- C-235/18 (Vega International) – Judgment- Financing in advance purchase of fuel is an exempted financial service

- VAT Committee – WP 1067 – Case C-235-18 Vega International – Fuel cards

- Presentation VAT Expert Group – Fuel cards subgroup – Case C-235/18 Vega International

- Conclusion of the EU Commission Services as regards the VAT treatment of the supplies of fuel cards

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases