- Input tax is the tax borne by the taxpayer when purchasing goods or services

- Tax can be deducted up to the amount due and carried forward if excess

- Fully deductible cases include tax on sales returns, inputs of goods and services, purchases for trading, imported goods, exempted sales, and sales to specific entities

- Proportional deduction for taxable vs. exempt sales

- Cases where tax deduction does not apply include table tax, input tax included in cost, exempted goods and services, and simplified taxpayer registration

- Compliance with tax deduction leads to reduced final tax, enhanced competitiveness, encouragement of investment, and improved tax efficiency

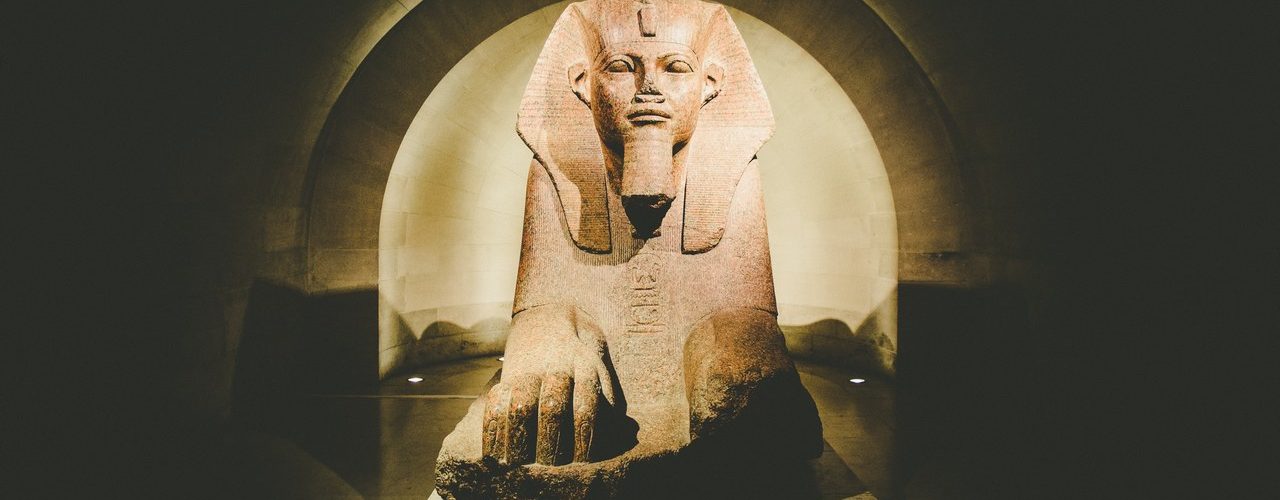

- Input tax deduction is a key part of Egypt’s strategy for economic growth and industrial productivity.

Source: eg.andersen.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.