- Excise tax is an indirect tax levied on goods or services deemed harmful or linked to health issues

- It serves to raise government revenue and discourage consumption of certain goods

- Excise taxes are specific and charged per unit or quantity, not as a percentage of the cost

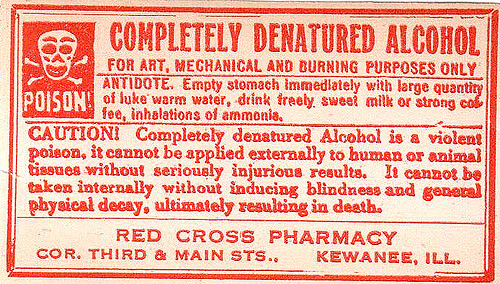

- They are imposed on goods like tobacco, alcohol, gasoline, airline tickets, and gambling

- Excise taxes can help fund public health initiatives and curb negative societal consequences

- They play a key role in governmental tax strategies due to their steady income stream and ability to achieve social policy objectives

- Calculating excise taxes can be complex due to variance in rates, applicability, and types of taxes

- Ad valorem taxes are assessed as a percentage of the product’s value, while specific taxes are charged per unit

- The choice of tax type can have significant impacts on consumers and producers, depending on the product or service.

Source: vertexinc.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.