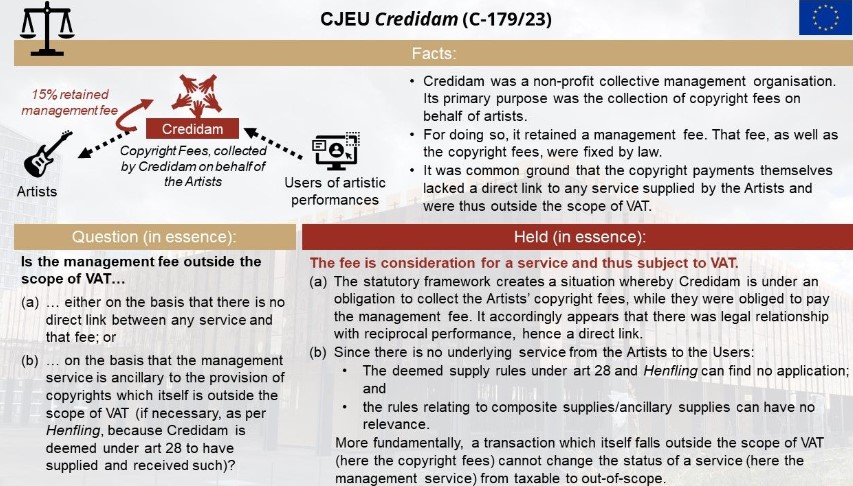

A great referral from Romania that significantly contributes to the development of EU VAT Law. Interesting is in particular the following point: once it is established that a transaction is inside the scope of VAT (as a supply of goods or services), it cannot fall outside thereof on the basis that it forms a single supply with an out-of-scope transaction. So, there can be for instance no supply ancillary to a TOGC. What the case itself leaves open is whether that also holds true the other way round, viz. whether something that is outside the scope of VAT cannot be brought into its scope by grouping it with an in-scope supply – but it would appear to be the result indeed if the principle is brought to its logical conclusion.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- Comments on EGC T-689/24: EU Court Ruling Eases VAT Deductions, Boosts Business Cash Flow, Impacts e-Invoicing System

- Comments on EGC T-689/24: Groundbreaking EU Court Ruling: Polish VAT Deduction Rules Must Align with EU Law, Favoring Taxpayers

- VAT Applies to Full Compensation, Including Penalties, for Unlicensed Public Use of Copyrighted Works

- ECJ Rules Designated Partners Not Liable for VAT on Other Partners’ Services in Partnerships

- EGC Rules on VAT Triangular Transactions and Fraud in Intra-Community Supply Chains