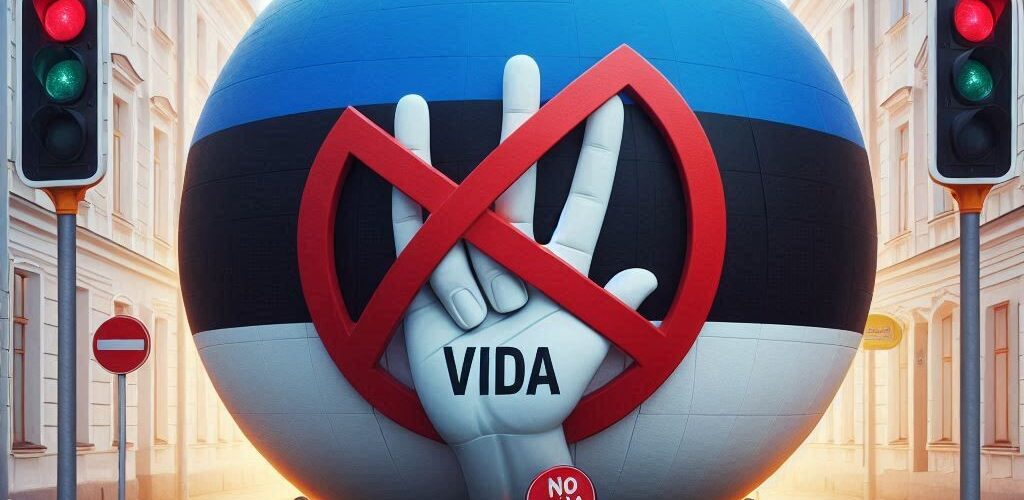

Status after the Ecofin meeting on June 21, 2024: Estonia does not agree to the pillar of VAT in the Digital Age (ViDA) and since there is no unanimity, there is no agreement on ViDA, also not on Digital Reporting Requirements and Single EU VAT registration.

Summary – Position Estonia

During the meeting, concerns raised in the May ECOFIN meeting still remained. Estonia expressed its opposition to applying the deemed supplier regime and believed that small businesses under the VAT threshold should not be charged VAT, regardless of the nature of their services. They argued that applying such a rule would burden SMEs and distort competition, particularly affecting SMEs in Estonia.

Estonia proposed a compromise of a voluntary deemed supplier regime, but it was not approved. Some countries wanted the option to opt-in to the supplier regime, while others preferred to maintain the status quo. The proposal aimed to allow each country to decide what suited their interests best, striking a balance between different positions.

Furthermore, Estonia highlighted the importance of the tax information they had started receiving from DAC7, which was a result of their collective efforts. They expressed concerns that if small businesses were taxed solely because they operated on digital platforms, it might push these businesses to provide services through other means, potentially leading to a shadow economy and the loss of transparency provided by digital platforms.

The concerns raised by Estonia regarding the deemed supplier regime and the potential impact on SMEs were discussed, but no final agreement or resolution was reached on these issues during the meeting.

Next: The Hungarian presidency will continue to work on the file

Source Public session (europa.eu)

Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE