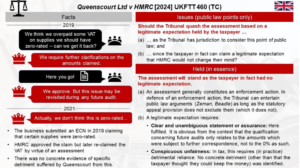

If tax authorities initially approve a tax refund claim but later change their decision, it may seem unfair. However, in legal proceedings based on a legitimate expectation, this alone is not enough. While there is occasional mention of the idea that “detrimental reliance” by the taxpayer is not strictly necessary, in practice it often is. This was evident in a court case and is generally the approach taken by the law. Businesses must be prepared for unexpected changes until the time limits for claims expire.

Source Fabian Barth