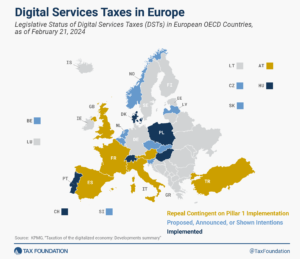

In recent years, there have been concerns about the international tax system not effectively addressing the digital economy. The current system taxes multinational companies based on production rather than where their consumers are located. To address this, the OECD is leading negotiations with over 140 countries to update the tax system. The proposed changes, known as Pillar One, would require large multinational businesses to pay taxes where their consumers are located. This would replace existing norms and could lead to the repeal of digital services taxes. However, the OECD missed the deadline to reach an agreement on Pillar One, casting doubt on the repeal of these taxes. Additionally, there are concerns about the potential loss of U.S. federal receipts under Pillar One.

Source Tax Foundation