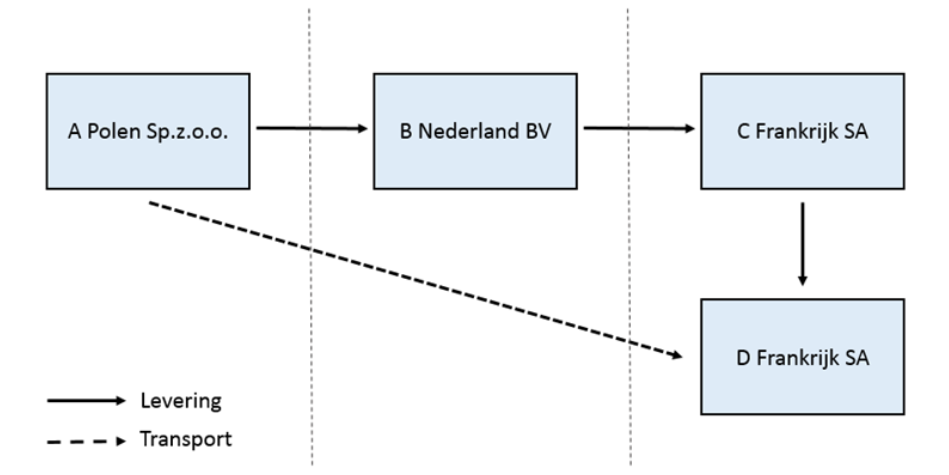

The Dutch tax authority has deemed that 4 party triangulation is permissible in certain cases. An example is given where a Dutch company purchases goods from a Polish supplier and arranges for the goods to be sent directly to the final customer in France. The French customer would self-account for the VAT due on the supply. It is noted that while this approach may be permitted in the Netherlands, other EU member states may have different rules.

Source Meridian