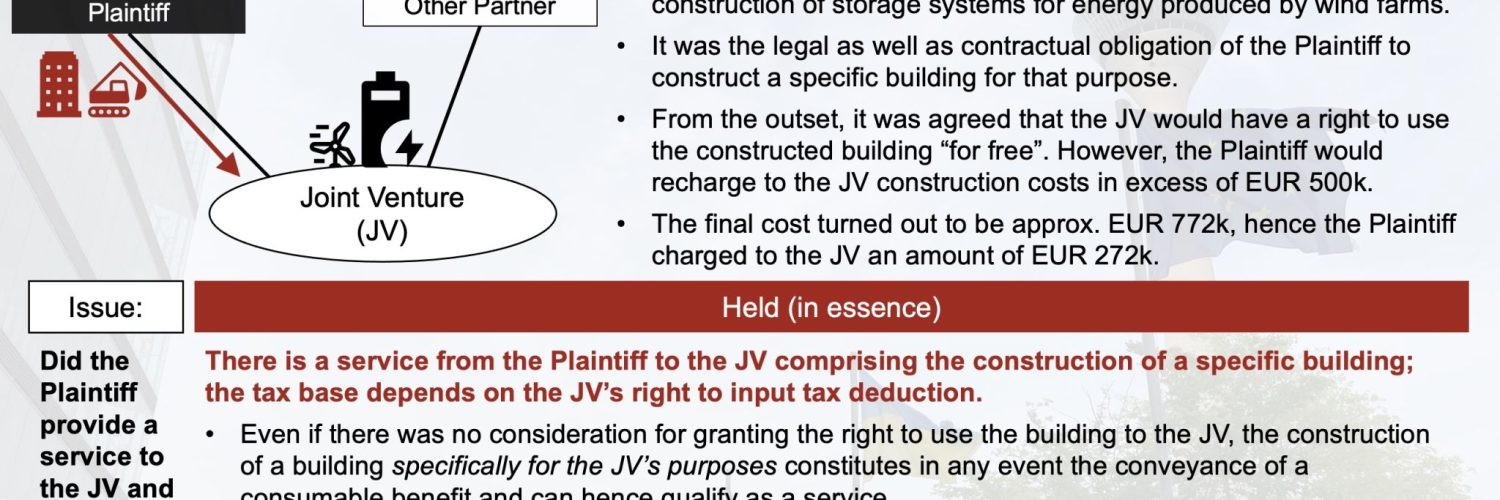

The case involved a taxpayer constructing a building for another party and allowing them to use it for free. The State Court initially ruled that there was no supply because the user did not receive anything in return for the construction costs. However, the Federal Court disagreed, stating that the construction of the building could be classified as a service and that the tax base could be elevated to EUR 772 due to some consideration being present. The interplay between Articles 26 and 80 of VAT law was noted as creating anomalous results, which the CJEU may need to review.

Source Fabian Barth

Latest Posts in "Germany"

- German Government Adopts Action Plan to Combat Organized Crime, Strengthens Customs and Federal Police

- BGH: Separate Offenses for VAT Pre-Returns and Annual Returns—Major Change in Tax Criminal Law

- Questionnaire for VAT Registration of Public Law Entities – BMF Letter Dated 23 February 2026

- New VAT Registration Forms for Public Law Entities Announced by German Ministry of Finance

- BGH: Separate Offenses for VAT Pre-Registration and Annual Return in Carousel Fraud Cases