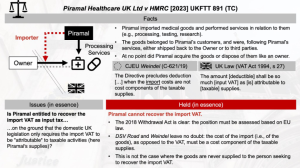

- To recover import VAT as input tax, a person must have the power to dispose of the goods and use them as cost components for their output supplies.

- If someone who only performs services in relation to the goods were to recover the import VAT, it would distort the VAT system.

- However, it is not necessary for the person recovering import VAT to be both the owner and importer, as this would violate neutrality.

- The Tribunal did not have to decide on this point, but it may be addressed in a future case.

- The judge also explained how EU law can override national law under the 2018 Withdrawal Act, and how the 2023 Revocation Act could have changed it, but it will not.

Source Fabian Barth

See also

- Roadtrip through ECJ Cases – Focus on ”Right to deduct VAT – VAT paid on the importation of goods” (Art. 168(e))

- C-187/14 (DSV Road) – No deduction of VAT on import by the carrier

- Point 49: In that regard, it must be noted that, under the wording of Article 168(e) of the VAT Directive, a right to deduct exists only in so far as the goods imported are used for the purposes of the taxed transactions of a taxable person. In accordance with the settled case-law of the Court concerning the right to deduct VAT on the acquisition of goods or services, that condition is satisfied only where the cost of the input services is incorporated either in the cost of particular output transactions or in the cost of goods or services supplied by the taxable person as part of his economic activities (see judgments in SKF, C‑29/08, EU:C:2009:665, paragraph 60, and Eon Aset Menidjmunt, C‑118/11, EU:C:2012:97, paragraph 48).

-

Point 50: Since the value of the goods transported does not form part of the costs making up the prices invoiced by a transporter whose activity is limited to transporting those goods for consideration, the conditions for application of Article 168(e) of the VAT Directive are not satisfied in the present case.

- C-621/19 (Weindel Logistik Service) – Order – Import VAT recovery only for the owner of the goods

- Point 46: By noting that the value of the goods transported does not form part of the costs constituting the prices invoiced by a carrier whose activity is limited to transporting these goods for remuneration, the conditions of application of Article 168 (e), of Directive 2006/112 are not met (judgment of 25 June 2015, DSV Road, C-187/14, EU: C: 2015: 421, paragraph 50), the Court clarified that persons who import goods without being the owners are not in a position to benefit from the right to deduct VAT, except to be able to establish that the cost of the importation is incorporated in the price of the particular downstream operations or in the price of the goods or services provided by the taxable person in the course of his economic activities.