The VAT package in the digital age (ViDA) is expected on December 7!

It is a long-awaited proposal for a series Including (very) far-reaching reforms.

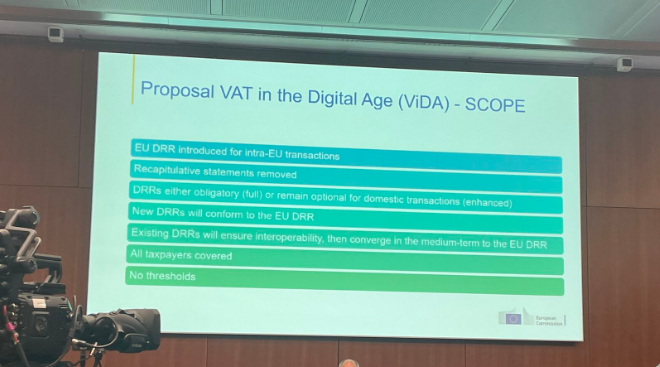

One of the most relevant parts concern new reporting obligations in the area of e-invoicing and e-reporting.

It will be a draft directive that still has to be formally adopted by the Council of the European Union and the European Parliament under the usual legislative procedure.

Source VATconsult

Latest Posts in "European Union"

- General Court T-643/24 (Credidam) – AG Opinion – Unauthorized use of copyrighted works incurs VAT on fees

- General Court T-646/24 (MS KLJUCAROVCI) – Judgment – Triangular transactions can qualify for VAT simplifications despite delivery variations

- Comments on GC T-657/24: VAT exemption for credit intermediation applies when the intermediary searches for and recruits customers

- Briefing documents & Podcasts: VAT concepts explained through ECJ/CJEU cases on Spotify

- ECJ on the relevant sale for determining the transaction value of goods