On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”VAT in the Digital Age”. This one is on the ”Platform Economy”

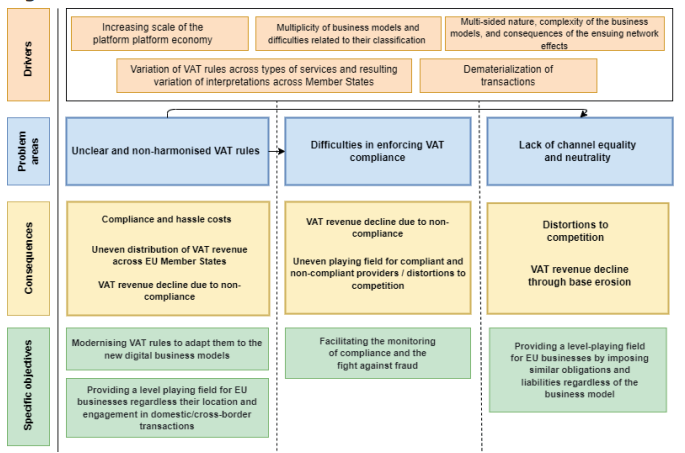

Five drivers were identified as root causes of the problems related to the VAT treatment of the platform economy, which are:

1) The increasing scale of the platform economy.

2) The multiplicity of business models and difficulties related to their classification.

3) The multi-sided nature and complexity of the platform business models and the ensuing network effects.

4) The variation of the VAT rules across types of services and resulting variation of interpretations across Member States.

5) The dematerialisation of transactions.

All in all, because of the drivers identified above, the current VAT rules are not applicable in a clear, uniform and equal way to the platform business models across the EU.

More specifically, three general problem areas were identified:

1) Unclear and not harmonised VAT rules, concerning: (i) the taxable status of the provider, (ii) the nature of platforms’ facilitation services and their place of supply, and (iii) the reporting and record keeping obligations.

2) Difficulties in enforcing VAT compliance in the platform economy.

3) Lack of VAT equality and neutrality.

The above problem areas result in a number of consequences which are harmful to the proper functioning of the Single Market (including both cross-border and intra-border competition), to the economic operators of the platform economy, as well as to Member States. In particular, they generate unnecessary costs and burdens, lower and inappropriately distributed VAT revenue, as well as distortion of competition

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)

- Part 12: Single EU VAT registration & IOSS – Current situation

- Part 13: Single EU VAT registration & IOSS – Problem definition

- Part 14: Single EU VAT registration & IOSS – Policy options

Latest Posts in "European Union"

- Recent ECJ and General Court VAT Jurisprudence and Implications for EU Compliance – February 2026

- Comments on T-575/24: Belgian commissioned association subject to VAT

- Comments on T-638/24: IC Acquisition also taxable in the event of wrongly charged VAT for exempt IC Supply

- ECJ & General Court VAT Cases decided in 2026

- EGC VAT T-53/26 (Central Europe Mark) – Questions – Examination of Tax Neutrality and Proportionality in Securing VAT Payments Without Interest Compensation