On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”Digital Reporting Requirements”

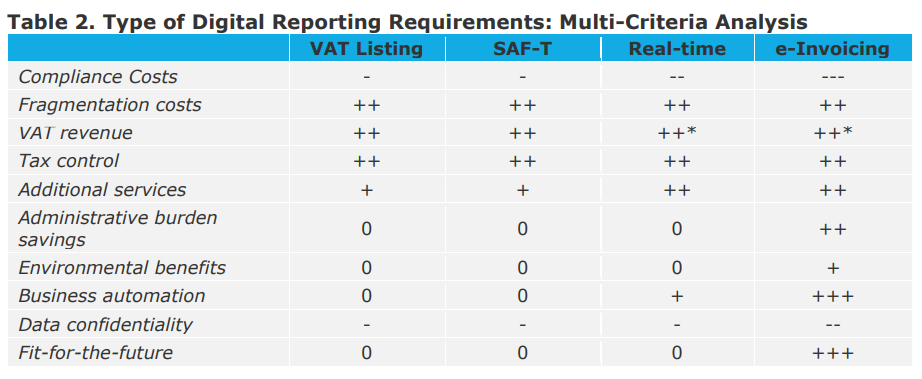

When it comes to other features of the EU DRR, the main conclusions of the analysis are as follows:

- Taxpayers covered. It is suggested to exclude from the scope of the EU DRR those taxable persons covered by the VAT special scheme for small enterprises or otherwise not identified for VAT purposes. Their inclusion would significantly increase compliance costs, with limited positive effects on VAT revenue and the fight against VAT fraud.

- Transactions covered. At least in its early phase, the EU DRR should focus on B2B and B2G transactions. While excluding a non-trivial amount of VAT transactions, this choice avoids imposing larger costs for those taxable persons only active in the B2C segment, mostly very small players. At a later stage, it may be appropriate to assess the extension of the EU DRR to the B2C segment, what costs would be generated, whether a different reporting system should be introduced, or whether the existing scope proved sufficient.

- Role of the customer. The existing evidence shows that the role of the customer is not decisive. Asking customers to verify or confirm transactional data does generate additional burdens, and these tasks could be performed more efficiently by the tax authorities, via automated means. Similarly, there seems to be no significant advantage when requiring the customer to accept and confirm the e-invoices received. This could increase the certainty of the fiscal document, also when used to obtain trade financing, but could also expose suppliers to abusive commercial behaviour. In any case, it is suggested that, if the customer is required to accept or confirm the e-invoice or data received, this is implemented via a silent-is-consent mechanism.

- Clearance vs. no-clearance. The limited available evidence on the pros and cons of the clearance system for e-invoicing shows, at present, no clear advantages for clearance. Benefits seem limited, although the costs and negative impacts due to the implementation of a clearance model in Italy also appeared negligible. Once a common EU e-invoicing architecture is set up, which companies can use ‘next to’ any local platform, one could consider leaving Member States free to opt for a clearance or no-clearance model for domestic transactions.

- Frequency of CTCs. The evidence points out that requiring submission within a few days of the transaction taking place has limited drawbacks for tax authorities compared to instant reporting. Furthermore, a slightly delayed reporting reduces complexity and costs, especially for the smallest taxpayers.

- Additional services and other obligations. The analysis strongly points out to the beneficial effects of additional services that can be provided to taxpayers following the introduction of any EU DRR, particularly the pre-filling of VAT returns and the removal of the recapitulative statements, which can partly compensate the compliance costs for businesses.

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)