On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”Digital Reporting Requirements”

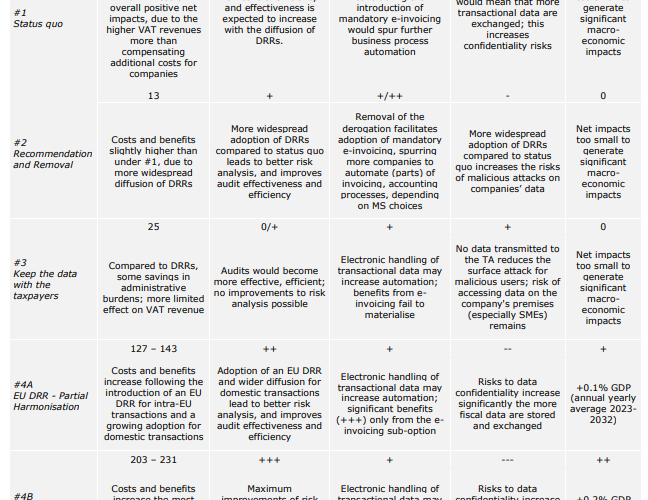

The following policy options are retained for the analysis of impacts:

- Option 1 – Status quo. No measures to harmonise the DRRs are introduced at EU level; a number of Member States are likely to introduce DRRs depending on their VAT Gap and the policy patterns of other Member States; the introduction of mandatory e-invoicing remains subject to a derogation being obtained and recapitulative statements are not modified.

- Option 2 – Recommendation & Removal. The introduction of DRRs remains optional for Member States; their introduction is encouraged for those Member States with a significant VAT Gap and supported by the Commission, provided that the new system conforms to the EU design. The core elements of the EU design are described in a non-binding Recommendation. The Recommendation elaborates on the design of both a transactional reporting mechanism DRR and an e-invoicing system. In parallel, the derogation currently needed to introduce

mandatory B2B e-invoicing is removed. Recapitulative statements are not modified. - Option 3 – Keep data with the taxpayers. No EU DRR is imposed; rather, a new provision is included in the VAT Directive requiring taxpayers to record transactional data according to a pre-determined format. The tax authority could access such records upon request. Member States remain free to maintain (or introduce) national DRRs. For Member States which introduce a DRR, compliance with the reporting mechanism would also ensure compliance with the new obligation (hence, no duplication).

- Option 4 – Introduction of an EU DRR.

- Option 4a. Partial harmonisation. An EU DRR is introduced for intraEU transactions; the recapitulative statements are abolished. DRRs for domestic transactions remain optional for Member States. Member States wishing to introduce such mechanisms should conform to the system used for intra-EU transactions. For Member States where DRRs for domestic transactions are already in place, interoperability must be ensured in the short-term; then, national DRRs are required to converge to the EU DRR system in the medium-term (i.e. in five to ten years).

- Option 4b. Full harmonisation. An EU DRR is introduced for intra-EU and domestic transactions alike. The recapitulative statements are abolished. For Member States where DRRs for domestic transactions are already in place, the interoperability clause applies in the short-term; then, national DRRs are required to converge to the EU DRR system in the medium-term (i.e. in five to ten years).

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)

- Part 12: Single EU VAT registration & IOSS – Current situation

- Part 13: Single EU VAT registration & IOSS – Problem definition

- Part 14: Single EU VAT registration & IOSS – Policy options

Latest Posts in "European Union"

- Ecofin report on EU VAT reforms

- Roadtrip through ECJ cases: Focus on Promotional activities/Discounts (Art. 79, 87, 90(1))

- Comments on ECJ case C-234/24 (Brose Prievidza): No VAT Exemption for Tooling Without Physical Movement

- Roadtrip through ECJ Cases – Focus on “Liability to pay VAT – Jointly and severally liability of the payment of VAT” (Art. 205)

- ECJ Customs – C-488/24 (Kigas) – AG Opinion – Traders must inform consumers about customs duties before contracts