On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”Digital Reporting Requirements”

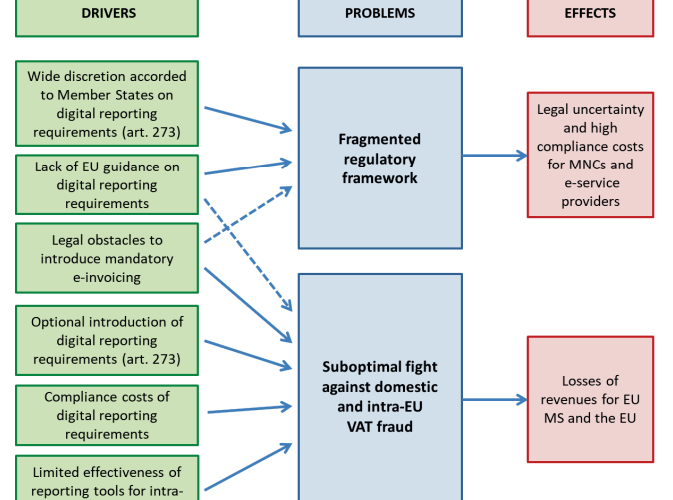

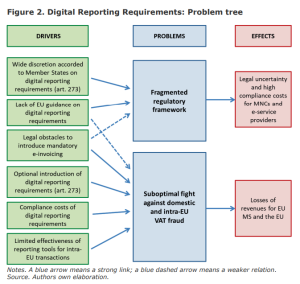

Existing Digital Reporting Requirements generate two main problems:

- First, the growing number of different reporting mechanisms introduced by Member States translates into a fragmented regulatory framework, which, in turn, results in legal uncertainty and additional costs for companies operating in multiple Member States and VAT service providers. This results in barriers to trade and inefficiencies in the functioning of the Internal Market.

- Secondly, the partial adoption of reporting requirements across the EU, also determined by the associated compliance costs, and the outdated tool for reporting intra-Community transactions (i.e. the recapitulative statements) do not allow Member States to effectively tackle VAT fraud. This gap concerns, firstly, intra-EU transactions, but also fraud at the domestic level. The potential VAT revenue losses attributed to the non-introduction of DRRs have been estimated at between EUR 22 and 27 billion per year. This would correspond to EUR 9 to 11 billion VAT revenue lost on intra-EU transactions only.

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)

- Part 12: Single EU VAT registration & IOSS – Current situation

- Part 13: Single EU VAT registration & IOSS – Problem definition

- Part 14: Single EU VAT registration & IOSS – Policy options

Latest Posts in "European Union"

- ECJ Overturns VAT Deduction Timing Rules: New Challenges for Tax Authorities and Businesses

- EU Abolishes the EUR 150 Customs Duty Exemption for Low‑Value Imports

- Abolition of the customs duty exemption for small consignments under EUR 150: what does this mean for e-commerce?

- Agenda of the ECJ/General Court VAT cases – 8 Judgments, 1 AG Opinion and 2 Hearings till March 18, 2026

- New ECG Case T-96/26 (TellusTax Advisory) – No details known yet