On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”Digital Reporting Requirements”

Part 1: e-Invoicing: Public Procurement (Status early 2022)

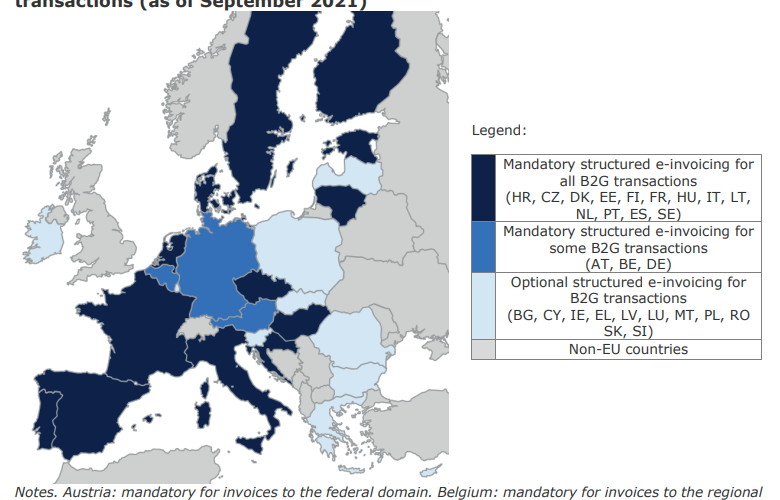

As for B2G transactions, according to the e-Invoicing Directive,10 Member States must require public administrations to accept structured e-invoices compliant with the European standard. A previous assessment of the EU invoicing legal framework proved that this requirement was instrumental in fostering the use of structured einvoices among economic operators in several Member States. Furthermore, the IT platform used to handle B2G transactions is often leveraged by the tax authorities for handling and reporting B2B transactions. This is what happened in Italy and what is going to happen in France over the near future; also in Romania, the B2G platform will be used to handle B2B e-invoices on a voluntary basis.

Though not explicitly provided by the Directive, the Member States may voluntarily impose a domestic obligation to use structured e-invoices for B2G transactions. Currently, 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform, and three more have a partial obligation in place for certain levels of government.

See also

- VAT in the Digital Age – Executive Summary

- Volume 1: Digital Reporting Requirements

- Volume 2: The VAT treatment of the platform economy

- Volume 3: Single place of VAT registration and import one stop shop

- Volume 4: Consultation activities

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)

- Part 12: Single EU VAT registration & IOSS – Current situation

- Part 13: Single EU VAT registration & IOSS – Problem definition

- Part 14: Single EU VAT registration & IOSS – Policy options

Latest Posts in "European Union"

- Comments on ECJ C-101/24 (Xyrality) – Judgment on app stores as VAT commissionaires

- ECJ Confirms Deemed Reseller Rule for App Store In-App Purchases

- VAT Challenges in Toll Manufacturing: Goods vs Services Classification Issues

- VAT and Transfer Pricing – Four recent cases @ ECJ/CJEU – 3 cases decided, 1 case pending

- Briefing document & Podcast: ECJ C-580/16 (Hans Bühler) – Late submission of recapitulative statements should not disqualify a business from exemptions