As UAE VAT is nearing 5 years of its implementation, almost all of us are aware that the threshold for mandatory VAT registration is AED 375,000.

To check the threshold, the laws require to aggregate inter-alia the turnover of ‘taxable supplies’ of the last 12 months or of the next 30 days. The turnover needs to be aggregated on a rolling basis and not on a calendar year basis.

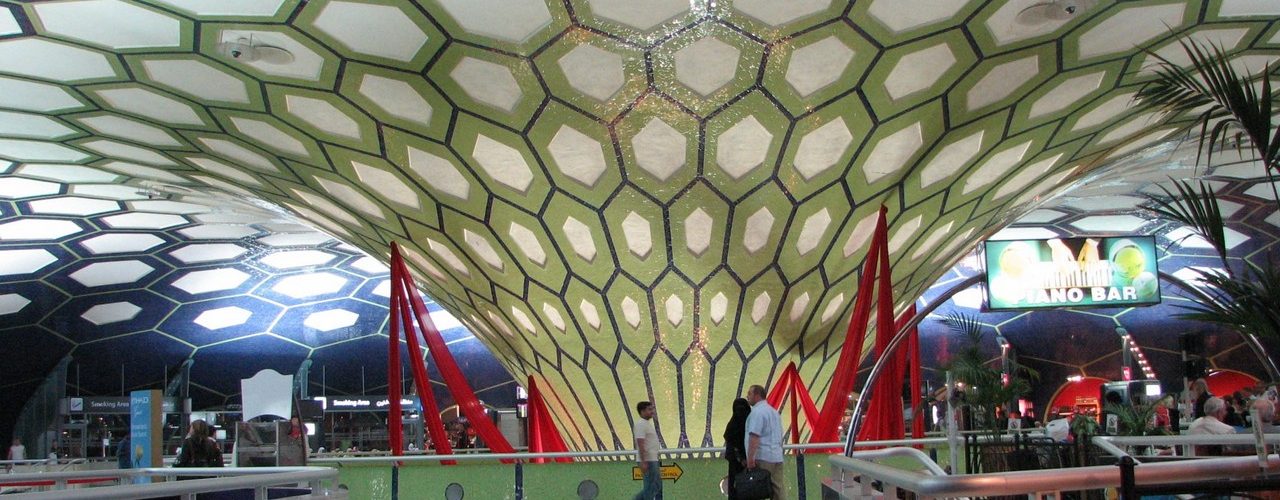

Source: Khaleej Times