To move to the right, right click mouse on the table and sweep to the right

European Commission proposal on VAT in the Digital Age and DAC8 will be published November 16, 2022

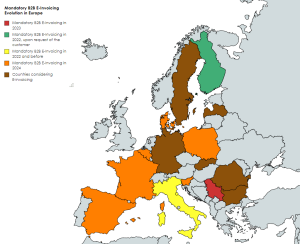

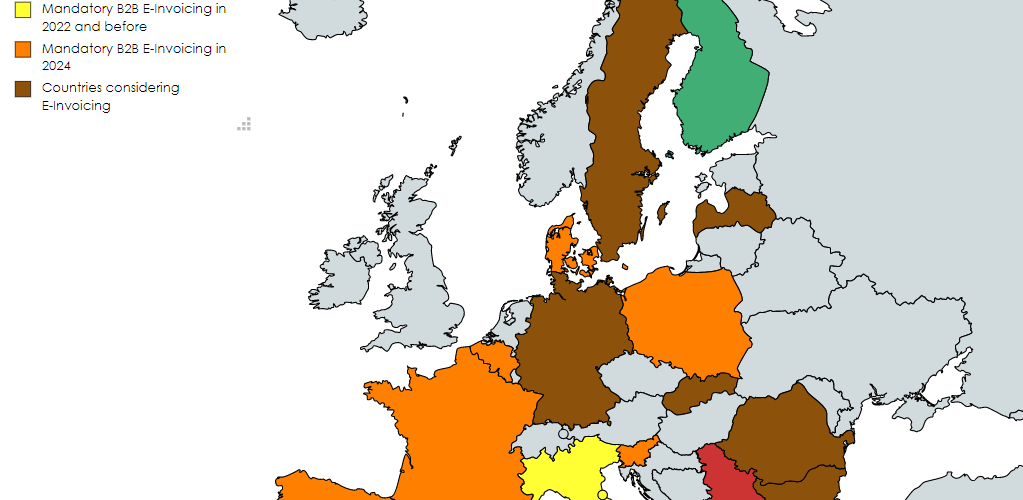

| Belgium | Draft | Gradual implementation of mandatory B2B E-Invoicing as of mid 2024? | |

| Bulgaria | Public consultation on mandatory B2B E-invoicing | ||

| Denmark | As of Jan 2024 | Approved | Mandatory B2B E-Invoicing implemented via Bookkeeping Act |

| France | As of July 1, 2024 | Approved | Mandatory B2B E-invoicing/Real Time Reporting |

| Germany | New coalition agrees on implementation E-Invoicing and Real Time Reporting | ||

| Hungary | Late 2022/Early 2023 | SAFT implementation late 2022/early 2023 | |

| Italy | July 1, 2022 | Mandatory Electronic invoicing scheme between Italy and San Marino | |

| Italy | July 1, 2002 | FatturaPA for cross-border invoice and abolishment Esterometro delayed till July 2022 | |

| Latvia | Draft – 2025 | Mandatory B2B and B2G | |

| Luxembourg | By 2023 | Mandatory B2G E-Invoicing | |

| Poland | Optional as of Jan 2022, Mandatory as of 2024(?) | Optional B2B E-Invoicing as of Jan 2022, mandatory as of Jan 2024? | |

| Portugal | 2022/2023 | ATCUD (delayed till 2023) and QR codes (Jan 1, 2022) obligatory invoice elements | |

| Romania | As of Dec 1, 2021 | eFactură electronic invoices registration as of Nov 1, 2021, mandatory application of B2B E-Invoicing and Real Time Reporting for high risk products as of July 2022 | |

| Romania | AS of July 2022 | July 2022 for large taxpayers, Jan 2023 for medium and 2025 for small paxpayers and non-residents | |

| San Marino | Oct 1, 2021 – Jully 2022 | E-invoice Requirement for Companies Selling Goods in Italy, voluntary Oct 1, 2021, Mandatory as of July 2022 | |

| Slovakia | As of Jan 1, 2023 | Draft | Mandatory B2G, G2G, and G2B E-Invoicing and Real Time Reporting as of Jan 1, 2023. B2B and B2C will follow in a later phase. |

| Slovenia | Plans to introduce B2B E-Invoicing | ||

| Spain | Jan 1, 2024 | Draft | Mandatory B2B E-Invoicing |

| Sweden | Consider SAF-T, VAT notification, Real Time Reporting, E-Invoicing – No concrete plans |