Highlights

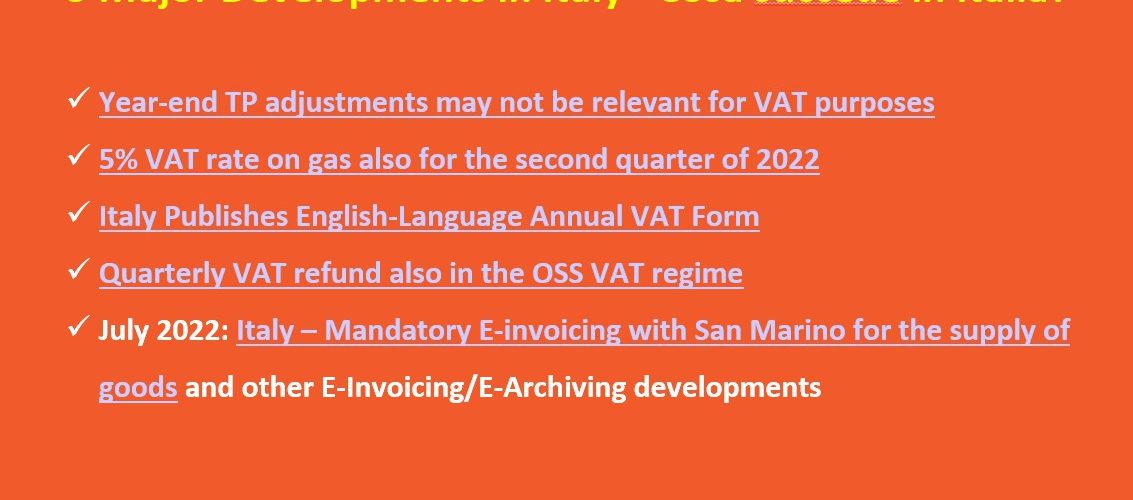

- Year-end TP adjustments may not be relevant for VAT purposes

- 5% VAT rate on gas also for the second quarter of 2022

- Italy Publishes English-Language Annual VAT Form

- Quarterly VAT refund also in the OSS VAT regime

- July 2022: Italy – Mandatory E-invoicing with San Marino for the supply of goods and other E-Invoicing/E-Archiving developments

2022 Budget

- 2022 Budget Law – New provisions in the VAT, excise and consumption tax field

- Circular No. 3/2022 to address tax measures from the 2022 Budget

- Review of VAT measures in 2022 budget law

- VAT measures for 2022, converted into law

- 2022 Budget: Plastic tax delayed, VAT rate on feminine hygiene products is reduced from 22% to 10%

Accounting/Archiving

Bad debts

- Circular about recovery of VAT on uncollected receivables in insolvency proceedings

- Circular on the conditions for bad debt relief

- Prompt recovery of VAT on outstanding receivables towards customers subject to insolvency proceedings

Chargeable event

- Clarification 859/2021: VAT advance payment by VAT group

- Ruling 859/2021: Correct determination of VAT advance payment within the scope of the VAT group

Customs

- Covid-19: Circular issued by customs authorities on VAT and Customs Duties relief for importation of medical equipment

- Medical Device Coordination Group published a new document on the obligations applicable to importers and distributors

DAC6

- Transfer Pricing Adjustments and Their Impact on VAT and DAC6

- Transposition of DAC6 Directive – cross-border mechanisms subject reporting obligation

ECJ

- Flashback on ECJ Cases – C-132/06 (Commission v Italy) – Validity of VAT amnesty

- Flashback on ECJ Cases – C-18/05 & C-155/05 (Villa Maria Beatrice Hospital) – Supplies of goods that were used exclusively for exempt activity and for which no right of…

- Flashback on ECJ Cases – C-378/15 (Mercedes Benz Italy) – Mixed-use revenue-based pro rata does not violate EU law

- Flashback on ECJ Cases – C-546/14 (Degano Trasporti) – Partial payment of VAT debts is not contrary to the obligation on Members States to ensure…

E-Commerce

- OSS & IOSS: Answers to the most frequently asked questions

- Quarterly VAT refund also in the OSS VAT regime

E-Invoicing

- Electronic invoice also for flat-rate operators

- Five key questions about e-Invoicing in Italy

- Italy updates VAT electronic invoicing requirements

- Italy’s updated e-invoicing archiving requirement

- SDI Italy: All about the 2022 cross-border e-invoicing mandate

Exemption

- Changes to the exemption for some international (transport) services

- Clarification 8/2022: VAT exemption for non-usage securities and valuables custody service

- Clarification 842/2021: VAT treatment of services provided in outsourcing for the realization of banking and financial operations

- Italy: Goods and Services supplied to combat COVID-19

- Live virtual tours in museums VAT exempted

- Restrictions to the VAT exemption for the international transport of goods as from 1 January 2022

- Tax Authorities Clarify VAT Exemption of Library Services

- The reform of the VAT exemption for commercial activities by non-profit associations

- The scope of VAT exemption for the international transport of goods has been restricted

- Transactions treated as exports: vessels used for high sea navigation

- Treasury services provided to a Municipality by a bank are exempt for VAT purposes

- VAT exemption also for derivative contracts

- VAT exemption also for marquees to carry out swabs

Flat rate scheme

Invoicing

- Bankruptcy before 2021: credit notes only after the unsuccessful conclusion of the procedure

- Fiscalization in Italy

- Ruling 762/2021: Clarification on the procedure to correct invoices

Liability to pay VAT

- Clarification 845/2021: Application of the reverse charge mechanism in relations between consortium members and consortium

- Import into Italy by a person not resident in the European Union

- Italy Sets Legal (Statutory) Interest Rate for 2022

- Reverse charge also for purchases of IT products not aimed at resale

- Reverse charge regime for tablet PCs and laptops – Clarifications

- Tax Authorities Confirm Application of Reverse Charge Mechanism to Supplies of Game Consoles, Tablet PCs and Laptops

- The “reverse charge” mechanism applicable to the sale of electronic products – recent clarifications from the Italian tax authorities

Other

- Bank of Italy: increase in digital payments supports VAT revenue

- Italian annual VAT prepayment

- The novelties of the VAT 2022 model

- VAT evasion, Guerra pushes on the use of big data: “Yes to profiling thanks to information integration”

Quick Fixes

Rate

- 5% VAT rate on gas also for the second quarter of 2022

- Clarification 35/2022: VAT rate for boxes containing ingredients for the preparation of meals – art. 16 DPR n. 633 of 1972

- Clarification 850/2021: Online subscription databases – reduced VAT rate of 4 percent

- Clarification 858/2021: Recovery of VAT paid following a change in the tax rate

- Italy cuts domestic gas to 5% for start of 2022

- Reduced VAT for vehicles adapted to the disabled: change the documentation to be presented

- Ruling 51/2022: Surgical glue – medical device – Ordinary VAT rate

- Standard VAT rate for in vitro diagnostic tests for narcotic drugs and psychotropic substances, and not aimed at combating Covid-19

- Standard VAT rate for surgical glue

- Supply of kits for the preparation of meals: which VAT rate applies

- Urgent Measures to Support Businesses in Relation to the COVID-19 Pandemic and Increased Energy Prices

- VAT rate applicable to the supply of food boxes with different ingredients

Real Estate

Refund

Reporting

- Italy approves the Annual VAT Return Form (Modello IVA) for 2022

- 2022 VAT return, draft model approved: deadline, instructions and news

- Annual VAT return for 2021 released

- Annual VAT return in English

- Approval of the technical specifications for the electronic transmission of the data contained in the 2022 annual VAT return relating to the year 2021

- Approval of the VAT/2022 return forms concerning the year 2021, with the relevant instructions

- Draft annual VAT return for fiscal year 2021

- Italy Approves Annual VAT Return 2022

- Italy Publishes English-Language Annual VAT Form

- New EC listing/INTRASTAT reporting requirements in Italy starting from Jan 1, 2022

- Real-time reporting models compared (Brazil, Hungary, Italy)

Right to deduct VAT

- Clarification on the Deduction of VAT Paid on Imported Goods

- Deduction and refund of VAT for expenses on property owned by third parties

- Tax Authorities Clarify Deduction of VAT Paid on Imported Goods

Tax authorities/Governance

Taxable amount

- Resolution no. 79/E/2021 – Taxable amount for VAT purposes of purchase of NPLs

- Sale of impaired receivables – VAT taxable base – Art. 13 of Presidential Decree

Taxable person

- Ruling 757/2021: Effective date inclusion of newly established companies in the VAT Group

- Ruling 800/2021: Use of the VAT number attributed to the permanent establishment following the nationalization of the foreign company

- Ruling 837/2021: Group VAT settlement – Requirement of control

- Seamless group VAT settlement even in the event of a company split

- The number of VAT numbers in Italy is at an all – time low

Taxable transactions

- Access to virtual tours – VAT treatment

- Business Restructuring—VAT Treatment of Transfer of a Going Concern

- Clarification 15/2022: Transfer of a swimming sports facility to the municipalities

- Italian Tax Authorities provide clarifications on VAT treatment of derivatives

- Italian Tax Authority Confirms Transfer Pricing Adjustments Not Subject to VAT

- Italy’s new clarifications concerning VAT treatment of transfer pricing adjustments

- Recharge of the electronic purse for the purchase of goods not yet defined is not relevant for VAT purposes

- Ruling 701/2021 on VAT Treatment of Publishing Fees

- The transfer of a swimming pool to shareholders can be classified as a transfer of a going concern

- TP adjustments: what treatment for VAT purposes?

- VAT regime applicable to the assignment of non-performing loans

- VAT regime of the chargeback of costs in execution of a decision of the Antitrust Authority

- VAT territoriality – complex service

- VAT treatment of distance learning courses

- VAT treatment of monetary differentials

- Year-end TP adjustments may not be relevant for VAT purposes

See also 5 Major VAT Developments in Italy (Dec 2021)