The European Council decided in July 2020 to introduce a new type of revenue for the EU budget (so-called own resources) based on the amount of non-recycled plastic packaging waste. From 1 January 2021, EU Member States are to pay 80 cent per kilogram of non-recyclable plastic packaging placed on their market. This tax supplements the EU revenue, to be paid by each individual EU Member State. Each Member State is free to decide how to implement/fund this new tax, some States may decide to pay the contribution to the EU from their own national budget but we expect that many will impose a new form of taxation on plastic packaging products.

Up till now, not any EU country has introduced a Plastic Tax to recover the amount paid to the EU budget.

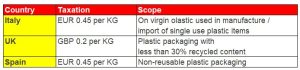

However, UK do have plans to implement a Plastic Tax in April 2022. Spain and Italy will likely followin 2023, Polish plans to implement a Plastic Tax remain vague.

- Italy – delayed till 2023

- Poland

- Spain – delayed till 2023

- United Kingdom – Implementation as of April 1, 2022

A summary:

Check also the previous articles on ”Looking back @2021”

- Brexit

- E-Commerce VAT Directive launched in the EU per July 1, 2021

- Next to the EU, 14 countries implemented VAT on E-Commerce, another 7 will implement in 2022

- Saudi-Arabia is the first country in the Middle East launching E-Invoicing, UAE may follow

- The concept of Fixed Establishments remains a major risk, and even why?

- Intrastat: Major updates applicable as of Jan 1, 2022

- Implementation/changes E-Invoicing & Real Time Reporting during 2021

- ECJ cases decided in 2021 on ”Taxable Amount”

- 49 ECJ VAT Cases decided (incl. orders) in 2021

- Split Payments

- Poland and France to introduce optional taxation of Financial Services – Exemption may not longer be applied

- Activities of the VAT Expert Group

- ECJ cases decided in 2021 on ”Exemptions”

- Pre-Filled VAT returns

- SAF-T (or equivalent) regulations, some more countries will implement