VAT compliance doesn’t come for free, however you choose to approach it. But is there a solid business case for investing in a tax engine to automate it? My answer is an emphatic “yes.” And, if you’d ask me to make my case in a single word, I’d say: “control.”

VAT may be one of your most substantial monetary flows. For some companies, the aggregate of input and output can be as much as 30% of total revenue. Tax authorities are increasingly imposing stringent reporting obligations, such as real-time reporting, SAF-T, and invoice clearance, which require first-time-right processing for VAT. In an invoice clearance model, for example, while there may be room for modifications, tax authorities will see the corrections, which could easily result in additional questions or an audit of the control framework.

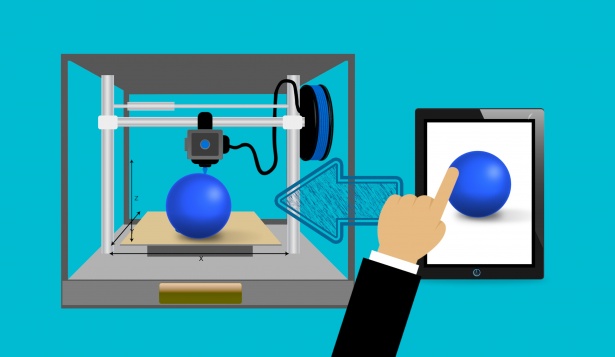

Source Vertex

Latest Posts in "World"

- Global eInvoicing: Trends, Models, Interoperability, and Innovation Shaping the Digital Future

- Turn Fiscalization Compliance into a Competitive Advantage: Free Webinar on October 30

- Webinar Fiscal Solutions: Turn Fiscalization Into a Competitive Advantage (Oct 30)

- Basware on YouTube – Compliance without the boring bits – Episode 5 (December 9)

- “How do I know if my Peppol e-invoice has arrived?” – A practical guide for entrepreneurs