On Jan 23, 2015, the ECJ issued its decision in the case C-590/13 (Idexx Laboratoires Italia).

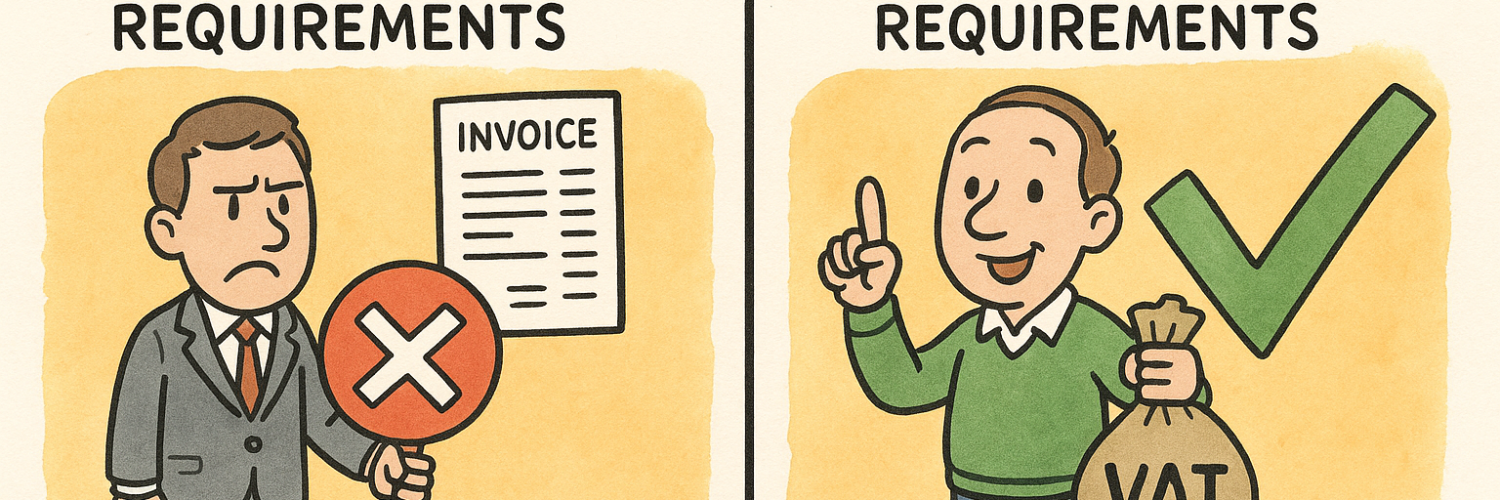

ECJ ruled that disrespecting the formal requirements relating to the right of input VAT deduction cannot result in the loss of that right if all substantive requirements governing such right are satisfied.

Summary

- Case Background: The case involves Idexx Laboratories Italia Srl’s dispute with the Italian Tax Authority regarding VAT assessments for intra-Community acquisitions in 1998. Idexx failed to meet specific formal requirements, including timely recording certain invoices in the VAT register and correctly registering invoices from a Dutch supplier, which were marked as ‘VAT exempt’ instead of being included in the appropriate VAT accounting records.

- Legal Questions: The Corte di cassazione referred questions to the Court regarding whether non-compliance with formal requirements under Articles 18(1)(d) and 22 of the Sixth Directive would result in the loss of the right to deduct VAT, despite meeting substantive conditions.

- Court’s Decision: The Court ruled that Articles 18(1)(d) and 22 contain formal requirements related to the right to deduct VAT, and failure to comply with these formalities does not lead to the loss of the right to deduct if substantive requirements are satisfied.

- Justification for Decision: The Court emphasized that the right to deduct VAT is fundamental to the VAT system, and formal requirements should not undermine this principle of fiscal neutrality. If authorities have sufficient information to confirm that substantive conditions for the deduction are met, additional formalities cannot invalidate the right.

- Outcome: The Court concluded that Idexx retains its right to deduct VAT despite not fulfilling specific formal obligations, such as the timely recording of invoices and proper classification of intra-Community acquisitions, reinforcing the importance of substantive compliance over mere formal adherence in VAT regulations.

Article in the EU VAT Directive

Articles 18(1)(d) and 22 of Sixth Council Directive 77/388/EEC

Article 18: Rules governing the exercise of the right to deduct

1. To exercise his right to deduct, the taxable person must:

(d) when he is required to pay the tax as a customer or purchaser where Article 21 (1) applies, comply with the formalities laid down by each Member State.

Article 22: Liability to pay VAT

Obligations under the internal system

1. Every taxable person shall state when his activity as a taxable person commences, changes or ceases.

2. Every taxable person shall keep accounts in sufficient detail to permit application of the value added tax and inspection by the tax authority.

3. (a) Every taxable person shall issue an invoice, or other document serving as invoice in respect of all goods and services supplied by him to another taxable person, and shall keep a copy thereof.

Every taxable person shall likewise issue an invoice in respect of payments on account made to him by another taxable person before the supply of goods or services is effected or completed.

(b) The invoice shall state clearly the price exclusive of tax and the corresponding tax at each rate as well as any exemptions.

(c) The Member States shall determine the criteria for considering whether a document serves as an invoice.

4. Every taxable person shall submit a return within an interval to be determined by each Member State. This interval may not exceed two months following the end of each tax period. The tax period may be fixed by Member States as a month, two months, or a quarter. However, Member States may fix different periods provided that these do not exceed a year.

The return must set out all the information needed to calculate the tax that has become chargeable and the deductions to be made, including, where appropriate, and in so far as it seems necessary for the establishment of the tax basis, the total amount of the transactions relative to such tax and deductions, and the total amount of the exempted supplies.

5. Every taxable person shall pay the net amount of the value added tax when submitting the return. The Member States may, however, fix a different date for the payment of the amount or may demand an interim payment.

6. Member States may require a taxable person to submit a statement, including the information specified in paragraph 4, and concerning all transactions carried out the preceding year. This statement must provide all the information necessary for any adjustments.

7. Member States shall take the necessary measures to ensure that those persons who, in accordance with Article 21 (1) (a) and (b), are considered to be liable to pay the tax instead of a taxable person established in another country or who are jointly, and severally liable for the payment, shall comply with the above obligations relating to declaration and payment.

8. Without prejudice to the provisions to be adopted pursuant to Article 17 (4), Member States may impose other obligations which they deem necessary for the correct levying and collection of the tax and for the prevention of fraud.

9. Member States may release taxable persons: – from certain obligations,

– from all obligations where those taxable persons carry out only exempt transactions,

– from the payment of the tax due where the amount is insignificant.

Facts

During the year 1998, Idexx effected intra-Community acquisitions of goods which were subject to VAT. Italian Tax Administration conducted a tax audit over that period and ascertained that the Company has failed to comply with the formalities of recording such intra-Community acquisitions in the books and it did not declare corresponding VAT liability. As a result, by the way of resolution the Tax Administration assessed the VAT liability deriving from those intra-community acquisitions of goods.

Idexx has filed an appeal on the resolution, stressing that the Italian Tax Administration had no right to request payment of the assessed VAT due to the fact that it has completely disregarded Idexx’s right to deduct related input VAT which, in the present case, cannot be disputed. The Company also noted that, in this case, the VAT liability is merely theoretical and it does not influence VAT position of the Company. That is because both VAT liability and deduction of input VAT deriving from intra-Community acquisition of goods are simultaneously declared (thus the final tax position equals to zero).

Questions

Are the principles established by the Court of Justice of the European Union (CJEU) in its judgment in Joined Cases C-95/07 and C-96/07 [Ecotrade spa v Agenzia delle Entrate [2008] ECR I-3457] – to the effect that Article 18(1)(d) and Article 22 of Sixth Directive 77/388, 1 as amended by Directive 91/680/EEC 2 on the harmonisation of the laws of the Member States relating to turnover taxes, preclude a practice whereby declarations are reassessed and value added tax recovered which penalises a failure to comply with, first, the formal requirements laid down by national law in implementation of Article 18(1)(d) and, second, obligations relating to accounts and tax returns under Article 22(2) and (4) respectively, by denying the right to deduct where the reverse charge procedure applies – also applicable in the case of total failure to comply with the obligations laid down by national law where there is, however, no doubt as to the status of a person as a person liable for payment of the tax or that person’s right to deduct?

Do the expressions ‘obblighi sostanziali’, ‘substantive requirements’ and ‘exigences de fond’ used by the CJEU in the various language versions of the judgment delivered on 8 May 2008 in Joined Cases C-95/07 and C-96/07 refer, with regard to situations entailing reverse charge VAT, to the requirement to pay VAT or the requirement of assumption of liability for the tax, or to the existence of substantive conditions which justify the imposition of VAT on the taxable person and govern the right to deduct, which is intended to safeguard the principle of VAT neutrality and of a single European system – for example, the presumption that there is an inherent connection between the goods purchased and the business carried on (‘inerenza’), whether VAT may be charged and whether it is totally deductible?

AG Opinion

None

Decision

Articles 18(1)(d) and 22 of Sixth Council Directive 77/388/EEC of 17 May 1977 on the harmonisation of the laws of the Member States relating to turnover taxes — Common system of value added tax: uniform basis of assessment, as amended by Council Directive 91/680/EEC of 16 December 1991, must be interpreted as containing formal requirements relating to the right to deduct, failure to comply with which, in circumstances such as those at issue in the main proceedings, cannot result in the loss of that right.

VATupdate comments

ECJ ruled that disrespecting the formal requirements relating to the right of input VAT deduction cannot result in the loss of that right if all substantive requirements governing such right are settled.

In the commentary of the ruling the ECJ stated the fundamental principle of neutrality of VAT requires the deduction of input tax to be allowed if the substantive requirements are satisfied, even if taxable person has failed to comply with certain formal requirements. Substantive requirements concerning the right to deduct input VAT govern origin and scope of that right. The Sixth Directive stipulated following substantive requirements in respect of deduction of VAT resulting from the intra-Community acquisition of goods: those acquisitions must be affected by taxable person who must be liable for VAT payable on those acquisitions and the goods in question must be used for the purposes of acquirer’s taxable transactions. On the other hand, formal requirements govern the way of executing the right of deduction and inspection over that execution (e.g. bookkeeping, invoicing and compliance requirements).

Following the above, the ruling in question provides that the tax authorities, even in cases where the VAT liability on intra-Community acquisition of goods is assessed by the way of resolution on the tax audit, cannot withhold the right to deduct input VAT if the substantive requirements for the deduction are settled. Note that the above mentioned substantive requirements provided by the Sixth Directive were transferred to the stipulations of the VAT Directive which is currently in force.

Source

See also

Reference to other ECJ Cases in the Judgment

- Ecotrade (C-95/07 and C-96/07): This case is pivotal in understanding the relationship between formal and substantive requirements for VAT deductions and is a key point of reference for the Court’s interpretation.

- Tóth (C-324/11): Cited to emphasize the fundamental principle of the right to deduct VAT and its integral role in the VAT system.

- Bockemühl (C-90/02): Referenced regarding the necessity for formalities not to exceed what is strictly necessary for verifying the correct application of the reverse charge procedure.

- Fatorie (C-424/12): Cited to illustrate that formal requirements should not undermine the neutrality of VAT and to reinforce the principle that the right to deduct must be maintained if substantive conditions are met.

- Uszodaépítő (C-392/09), Nidera Handelscompagnie (C-385/09), EMS-Bulgaria Transport (C-284/11): These cases were referenced to establish the principle that non-compliance with formal obligations does not automatically negate the right to deduct, provided the substantive conditions are fulfilled.

- Commission v. Netherlands (C-338/98): This case is mentioned to clarify the distinction between formal and substantive requirements concerning VAT deductions.

Newsletters

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- ECJ Opinion Sheds Light on VAT for Ancillary Services in German Accommodation Sector

- Briefing document & Podcast – C-409/04 (Teleos): Physical Movement & Supplier Due Diligence Key for Intra-EU VAT Exemption

- EU boosts tax cooperation with Andorra, Liechtenstein, Monaco, and San Marino

- Briefing document & Podcast: ECJ C-271/06 (Netto Supermarkt) – VAT exemption granted if fraud undetectable with due commercial care

- Switch to New EU Portal for Customs Applications and CBAM Access Starting 2026